News - Everything AI

Is ChatGPT Winning the AI Race?

by Patrick Amhaz

September 12, 2025

.jpg) Advertisement

AdvertisementThe AI chatbot race has heated up in 2025 with more players entering the scene and shaking up the market. But despite the rising competition, and people having more chatbot options than ever, ChatGPT remains the top choice.

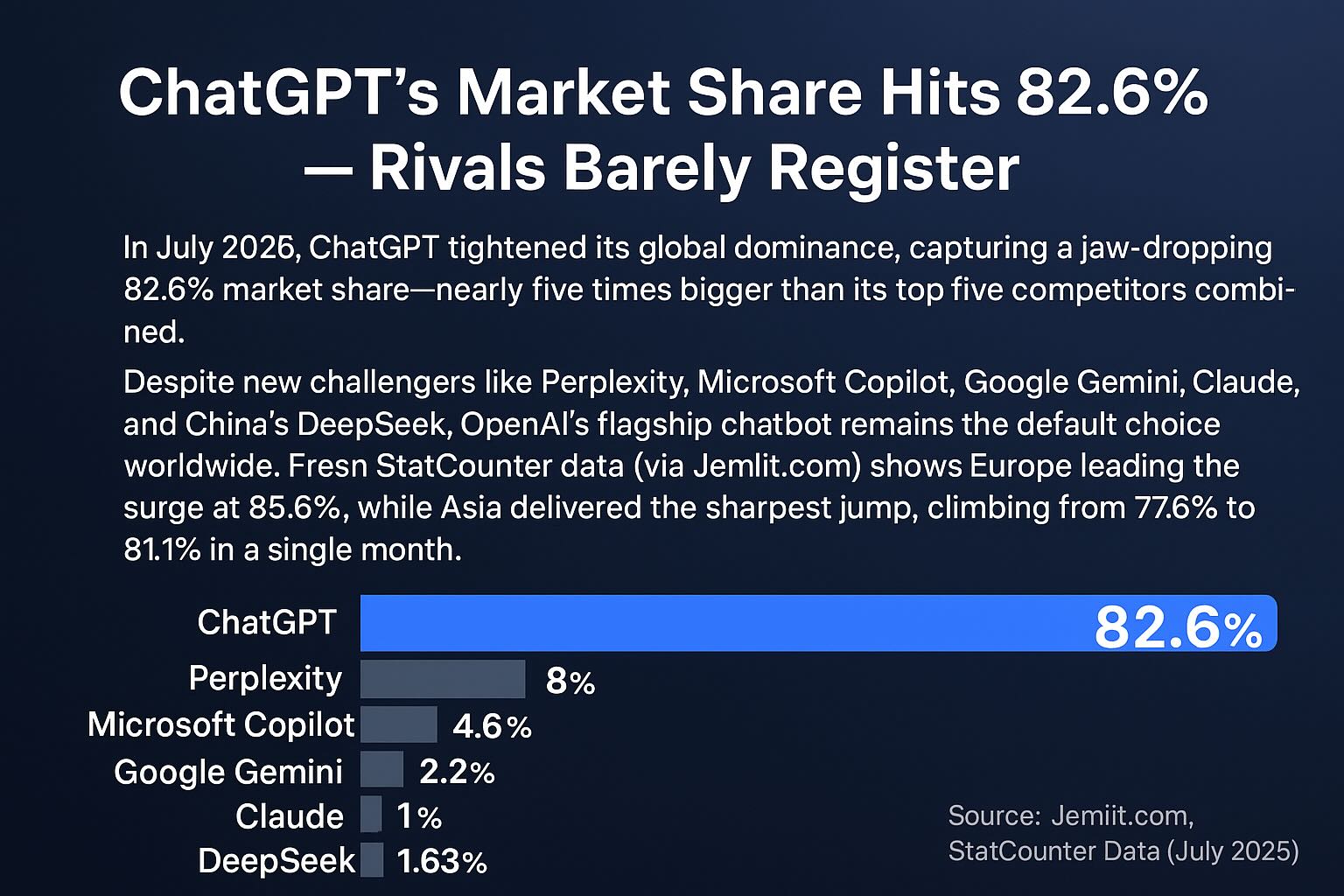

According to data presented by Jemlit.com, ChatGPT's market share surged to 82.6% in July, nearly five times larger than its five biggest competitors combined.

Despite an influx of competitors in 2025, ChatGPT has tightened its grip on the global AI chatbot market—commanding a staggering 82.6% share in July, nearly five times larger than its top five rivals combined.

The generative AI landscape is getting crowded.

From Perplexity to Microsoft Copilot, Google Gemini, Anthropic’s Claude, and China’s DeepSeek—new names keep popping up, each promising to redefine the way we interact with machines.

Yet, when it comes to actual usage, most consumers continue to say: “Just give me ChatGPT.”

According to fresh StatCounter data published by Jemlit.com, OpenAI’s flagship chatbot not only clawed back lost ground in July after a dip earlier this year but surged nearly 3% in a single month to hit an overwhelming 82.6% global market share. That’s dominance, not competition.

Regional strength, global spread

Europe remains ChatGPT’s fortress, where it now controls 85.66% of the market, still slightly below the nearly 90% it enjoyed in April. In the United States, where most active generative AI users are based, ChatGPT rose to 80.1%, while Asia recorded the sharpest leap, from 77.6% in June to 81.1% in July.

The message is clear: whether you’re in Boston, Brussels or Beijing, ChatGPT is the tool of choice for everyday AI tasks, even as rivals race to differentiate.

Rivals falter, DeepSeek sneaks in

The StatCounter breakdown paints a tough picture for competitors.

Perplexity, once hailed as the “fastest-rising rival,” fell to just 8%, down from 11% a month prior. Microsoft Copilot slid to 4.59%, Google Gemini plateaued at 2.19%, while Claude slipped below the 1% line.

The only outlier? DeepSeek, the Chinese entrant that quietly doubled its footprint in just a month, moving from 1% to 1.63%. While still tiny compared to ChatGPT, its growth signals that China’s domestic AI push might not stay domestic for long.

Why ChatGPT’s lead matters

Three years in, ChatGPT has become a category-defining platform, shaping expectations and consumer habits across sectors.

For businesses and brands, this matters, as user behavior consolidates around the tools that feel both reliable and omnipresent. And with five competitors combined failing to match even a fifth of ChatGPT’s share, OpenAI has set a high barrier to entry that latecomers may struggle to cross.

.jpg)