Art & Design

Demand for flexible space to gain momentum in the long run as corporates adopt a hybrid working model

August 31, 2020

Two interrelated trends have combined to shape and define demand for office space at the global and regional level in recent years - the increased demand for flexible offices, and the growth in remote working and working from home (WFH). While both of these trends predate COVID-19, the global pandemic has exacerbated their influence, and their impact on how office spaces are reimagined for many years to come, according to global property consultant JLL.

JLL’s latest report highlights the evolving nature of office spaces and the attractions, limitations and market trends that will emerge as a result of flexible space being applied on a sustained basis. The report indicates that flexible space will take a different form than it has in the past, but will continue to grow as corporates and investors respond to the increasing demand for flexibility brought on by COVID-19.

“While we believe there is some short-term pain as demand for flexible office space contracts, it seems certain to grow in the mid-to-long term as businesses adjust and adopt solutions that increase their agility and reduce their response times. The impact is also expected to translate onto the business models of flexible office operators, resulting in a shift away from common facilities, shared services, and hot desks, to a corresponding growth in the proportion of private space, which ensures corporate privacy and data security,” said Dana Salbak, Head of Research for JLL MENA.

“In reality, in-office work and remote work are complementary, and neither can completely replace the other. The post-pandemic workplace will involve a combination of three distinct office environments: the corporate office, flexible co-working facilities and remote working. The challenge for occupiers will be to establish the right mix and balance between the different settings and working patterns.”

“On a regional scale, extensive strides have been taken by Dubai to ensure flexible workspace frameworks are fixed and maintained in line with intensified measures aimed at combating COVID-19. To meet the growing demand, there has been a rapid increase in total supply of flexible office space in the Emirate. Although the effort is gaining momentum, the level of flex space in Dubai remains below the EMEA average of 2.3%, suggesting there is room for further growth,” said Toby Hall, Director - Head of Office and Business Space Leasing for JLL MENA.

JLL’s report identifies the below key trends which will continue to drive demand for flexible space in the region over the long term:

- A shift in demand: Based on structured conversations with more than 20 major corporates in Dubai, the report highlights that most companies see flex space as part of their overall portfolio mix going forward. The major factor in deciding which flex facility to favour appears to be the reputation of the operator, followed by the profile of other tenants. Interestingly, factors such as cost, and location of the space appear to be considered of lessor importance in the choice of flex space compared to more traditional leases.

- Market consolidation: Driven by the shift in the global flex market away from SME’s to larger corporates, the Dubai market is expected to experience more concentration in the hands of fewer but larger operators. This will inevitably involve a setback to some independent operators and is likely to be exacerbated by short time financial pressures resulting from COVID19.

- The future is private: COVID19 is resulting in a global shift away from shared co-working facilities to more private and enclosed spaces. This trend is also apparent with the majority of centres offering only enclosed offices or a hybrid mix of enclosed offices and co-working space. Centres that were originally targeting the co-working sector are now seeking to remodel their space to offer more enclosed offices.

- Diversified locations: Another trend we anticipate is for more flexible office facilities to be accommodated in non-office buildings. Given the particular oversupply in the retail and hotel markets, a number of developers are currently looking at opportunities to incorporate flexible office concepts space within vacant or underutilised space within retail malls or hotels. These properties offer a number of attractions for flexible office operators including generous parking & access to retail, food services and other supporting facilities.

“While the increase in remote working will result in less demand for office space in the future, the reduction in densities due to new social distancing measures will increase the amount of space required to house a given level of office staff. It is clear that the long-term impact of COVID19 on office demand is far more nuanced than many are suggesting, with a broad range of factors impacting demand,” Salbak concluded.

Topics

Recommended

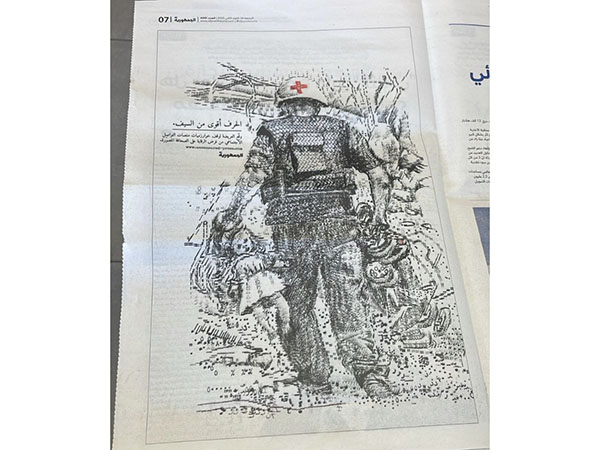

'Uncensored Press’: Overcoming algorithmic censorship to uncover war’s truth

An exciting collaboration between adidas Arabia and earth artist David Popa brings together the power of art, nature and sports