News - News In Brief

Purchases on UAE shopping and finance apps grew significantly, says AppsFlyer

May 23, 2022

Mobile spending is increasingly driving revenues for UAE businesses, and with nine in ten organisations in the Emirates now offering mobile apps, it is critical for businesses to capitalise on seasonal trends in order to grow their mobile app revenues.

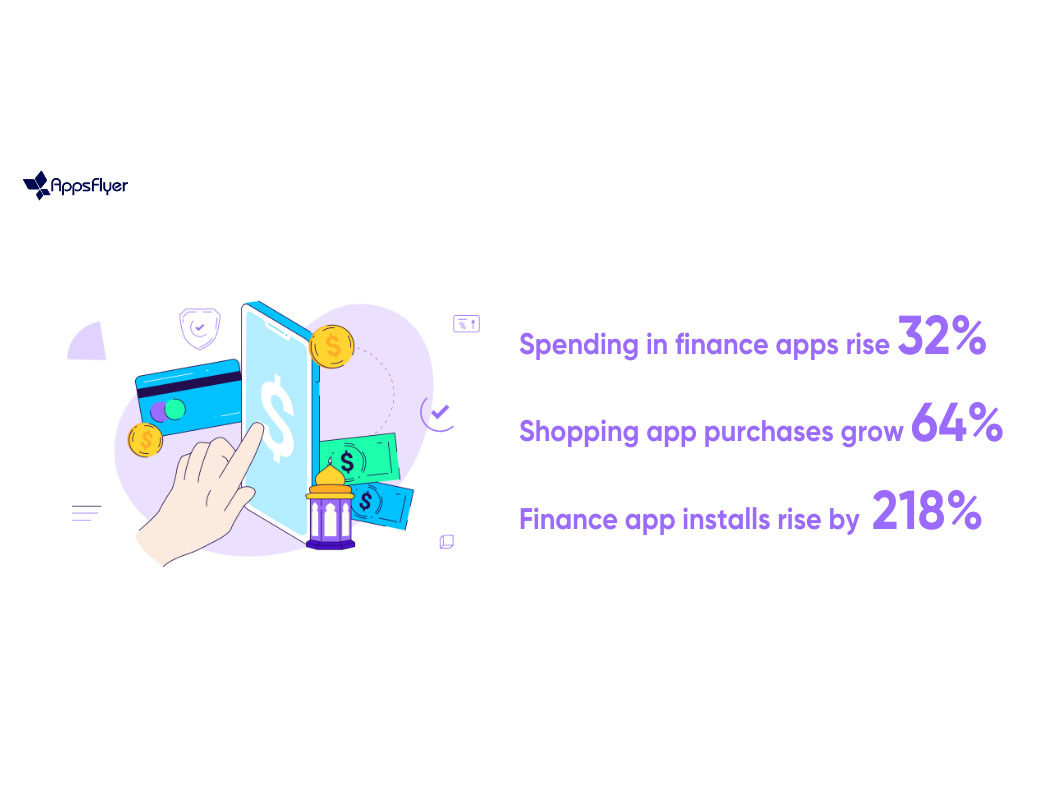

New research by AppsFlyer — which compared mobile app trends in Ramadan 2022 to Ramadan 2021 — has revealed that the Holy Month is increasingly becoming an unmissable opportunity for UAE organisations to grow revenues as in-app purchases on shopping and finance apps grew 64% and 32% respectively.

“Ramadan has once again proved to be a critical period for UAE organisations to capitalise on users’ growing preference for engaging with businesses via their mobile apps. Those that have grown their customer base through this period will be well advised to now focus on retargeting newly acquired users to ensure they are effectively converted into loyal, long-term brand advocates,” said Samer Saad, Regional Manager – Middle East, AppsFlyer.

Finance Apps Growing in Popularity

The study, which analysed trends in shopping, finance, and gaming apps, found finance apps to be the big winner during the Holy Month this year. These apps saw a 218% increase in installs compared to Ramadan 2021, which goes a long way in explaining the 32% increase in finance in-app purchases. AppsFlyer’s data also highlighted that marketers at finance organisations who focused on mobile campaigns were tangibly rewarded for their efforts as non-organic installs — app downloads that occur after a user sees a marketing campaign — of finance apps grew an incredible fourfold (441%).

Mobile Shopping App Market Near Saturation

An interesting finding of the study is that while in-app purchases on shopping apps grew significantly, overall app installs for this segment dropped by 26% this Ramadan compared to the last.

This seems to indicate that the shopping app market is reaching a level of maturity wherein established players have the opportunity to increase consumer spending on their mobile platforms, but newer entrants will find it increasingly challenging to secure a spot for their apps on users’ smartphones. It’s no surprise then that the 49% increase in remarketing conversions — app spending driven by campaigns that aim to re-engage users that have already downloaded an organisation’s app — seen this Ramadan were primarily driven by shopping apps.

“Previous research commissioned by AppsFlyer found that the overwhelming majority (84%) of UAE businesses believe mobile apps are a ‘must’ to stay relevant to their customers. But as more and more organisations look to cater to mobile consumers, the market will reach a saturation point,” continued Saad. “Businesses that have succeeded in securing a place on users’ smartphones will have to work hard to ensure these customers stay engaged. On the other hand, those that are looking to drive app downloads should pay close attention to the timing of their user acquisition campaigns as clearly, periods such as Ramadan offer a unique opportunity to yield greater results from their efforts.”

UAE Marketers Make User Privacy a Priority

Following the landmark iOS 14 privacy update which limited access to user-level data and therefore forced marketers to rethink their approach to targeting iPhone users, it was encouraging to see that UAE marketers have begun to update their iOS marketing strategies with positive results. AppsFlyer’s report showed that overall app installs on iOS devices grew by over a quarter (26%) this Ramadan, compared to the last, while non-organic installs grew 16% over the same period.

“Privacy is here to stay, and rightly so. Organisations that recognise this and reconstruct their marketing approach to prioritise user privacy will stand to succeed in the long-run. Our data shows that forward-thinking UAE organisations have already begun to adapt to this privacy-first paradigm, and are being rewarded for this shift. For those that are yet to break their dependency on user level data, the right strategy would be to invest in the ability to analyse and work with aggregated data which can still drive impactful campaigns,” Saad added.