Industry Talk - Interviews

Pikasso's Antonio Vincenti on How Lebanon’s OOH Industry Can Regain Its Marketing Momentum

by Ghada Azzi

June 23, 2025

.jpg) Advertisement

AdvertisementLebanon’s outdoor advertising sector has been navigating a complex and challenging landscape shaped by economic instability, skyrocketing costs, and regulatory pressures. Yet, signs of revival are emerging. Major international brands like Visa and Johnson’s have returned to the streets, marking a visible comeback after years dominated by local players.

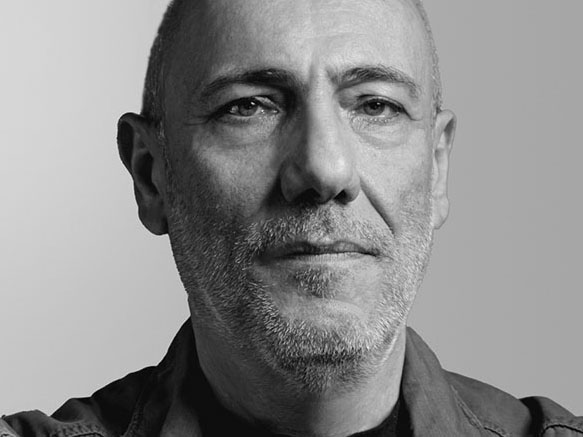

In this exclusive interview, Antonio Vincenti, CEO of Pikasso and a key industry leader, reflects on the Out-of-Home (OOH) business today.

As Lebanon slowly regains its marketing momentum, the outdoor space may not only bounce back—but evolve into something smarter and more dynamic believes Vincenti.

This conversation sheds light on how companies like Pikasso are adapting through pricing shifts, strategic downsizing, and renewed investment in digital and programmatic technologies. As the sector evolves, collaboration and strong industry leadership will be key to ensuring its resilience and long-term growth.

How would you describe the state of the outdoor advertising sector today? Has OOH media made a noticeable comeback in Lebanon?

The comeback you mention is noticeable, as it has been a long time since brands like Visa and Johnsons have been seen in OOH campaigns. In recent years, such campaigns have mainly been activated by local FMCG brands.

While outdoor advertising is a key part of the marketing mix, many billboards and unipoles in Lebanon still appear empty. What do you think is behind this?

In a normal world, during a crisis, OOH operators usually review their inventories. This is what we did at Pikasso, curtailing at least 1,000 faces. However, we have not seen other players do the same exercise, which leads to a growing imbalance between supply and demand.

Outdoor advertising has traditionally been seen as an expensive medium, particularly compared to the cost-effectiveness of digital media. Have there been any significant adjustments to the pricing structure in Lebanon?

When it comes to pricing, we went through every possible scenario, from losing part of the outstanding market dues, to getting paid in an undervalued currency, to selling in local currency until September 2021, then to selling at reduced, symbolic “fresh” dollars before being able to somehow adjust rates.

Our direct costs of course come from three key elements: municipal taxes and landlord leases, salaries and related charges, and general expenses, including technical and maintenance charges.

Leases have skyrocketed since July 2024, the most common benchmark for individual landlord being restaurant occupancy.

“The main challenge

we have been facing since Q4 2024

- and which will be felt even more from now on -

is the skyrocketing increase in municipal taxes."

“The main challenge

we have been facing since Q4 2024

- and which will be felt even more from now on -

is the skyrocketing increase in municipal taxes."

Do you anticipate any challenges in adapting to new rules and regulations related to outdoor advertising under the current government?

The main challenge we have been facing since Q4 2024 and which will be felt even more from now on is the skyrocketing increase in municipal taxes. Some municipalities have taken a somewhat logical approach to reassessing advertising taxes, limiting increases to 10, 20, or even 30 times the previous rates. However, others have gone beyond 60-fold increases, putting us in a position where settling our dues becomes impossible.

Currently, municipalities lack resources, as they struggle to significantly readjust residents’ municipal taxes on their flats or homes, who are always prioritized over non-voters.

As a result, they are shifting the burden onto commercial, industrial, and OOH advertising activities, which becomes a direct threat to our survival.

The solution lies in having a strong and active trade association. SOACL, which I co-founded with some colleagues and that I previously presided, plays a crucial role in this effort. However, my term ended several years ago, and I now need to pass the baton to someone who has the time and commitment to advocate for the greater good and defend our industry.

I have already made some attempts to do so, and my main objective for 2025 is to successfully transition the leadership of the OOH association to a new board that will act professionally to address this urgent threat.

We are aware that Pikasso has expanded its footprint to new markets. Could you share some insights into this expansion?

In June, we will be celebrating 25 years of Pikasso Jordan. Since then, our international expansion has focused on three key regions: the Levant, North & West Africa, and a standalone operation in Armenia.

Following Lebanon’s economic collapse, we made the strategic decision to establish Pikasso Italia, allowing us to gain experience in operating within the European market.

Across most of our markets, we operate in all three segments of OOH: billboards (including large formats), street furniture (including malls and retail), and transport. Our level of concentration in each segment varies depending on our strategic approach to each market and the opportunities we identify.

We are committed to developing our activities and ensuring stability and sustainable growth in these markets.

“DOOH is expected to surpass 50% of most markets,

and after some dark years,

Lebanon will be no exception to this trend.”

In your opinion, will the OOH sector bounce back stronger? And what role do you think digital screens, and smart technology will play in shaping the future of outdoor advertising in Lebanon?

DOOH is expected to surpass 50% of most markets, and after some dark years, Lebanon will be no exception to this trend.

The flexibility offered by digital screens from instant broadcasting and real-time content updates to contextual relevance make them a powerful medium. Additionally, when equipped with audience measurement devices, they provide valuable data insights. Also, the rise of Programmatic DOOH (pDOOH), which integrates digital screens on the same multi-channel digital planning platforms, makes it a central media buy.

So yes, AdTech will undoubtedly shape the future. The good news is that we have already turned back on 20 of our DOOH billboards as part of the Beirut Digital Constellation. Our target is to reach 40 screens on-air, out of the 64 that were operational before October 31, 2019, when we had to turn them off.

.jpg)