News - Advertising

Lebanon’s adspend and brands, agencies top 10 performers rankings for 2019

by Ghada Azzi

May 19, 2020

Advertising spend has always been a contentious issue. Every year upon the publication of our Top 10 Performers report, a polemic arises around its findings. And that polemic is based on the accusation that the region’s adspend figures are erroneous and damaging to the industry.

To be honest, those who hold such beliefs are right. It would be almost impossible to find a single person who pays rate card for a TV spot. And you certainly don’t have to be a data analyst to realise that a rate card figure of $1.3 billion for the Lebanese market is simply insane. That’s why something needs to change.

As a magazine dedicated to the advertising and media industry, it is our duty to provide reliable figures. Without them, neither us or the industry can be viewed as credible. We need to find a solution to the continual debate over adspend figures. And, for us, part of that solution means getting the industry together under one roof to discuss the naked truth.

That’s why we held a round table with industry stakeholders to ascertain the real level of advertising spend in Lebanon. Because if everyone agrees that only greater industry collaboration and an overhaul of the methodology used for measuring adspend can produce a truer picture of the industry, that’s what we need to do. We need to reduce the gap between fiction and reality.

During a lively round table discussion—a first of its kind--involving senior media players from the Lebanese market, we did just that. The debate was intense and heated at times, but inspiring and instructive.

Those present were Publicis’ Joyce Hallak and Cedric Barsoumian, Spark’s Paul Seif, Joyce Tawil of GroupM, Rachid El Khazen of OMD, Maroun Hassoun and Choucrallah Abou Samra of PHD, MCN’s Colette Cherfane and Carole Hayek, George Jabbour, president of the Advertising Association (AA), and Christian Saab from Ipsos.

.jpg)

Why these particular people? Because we believe their agencies represent the majority of advertising spend in Lebanon. As such, they offered the best opportunity for us to reach an acceptable estimate of the country’s adspend.

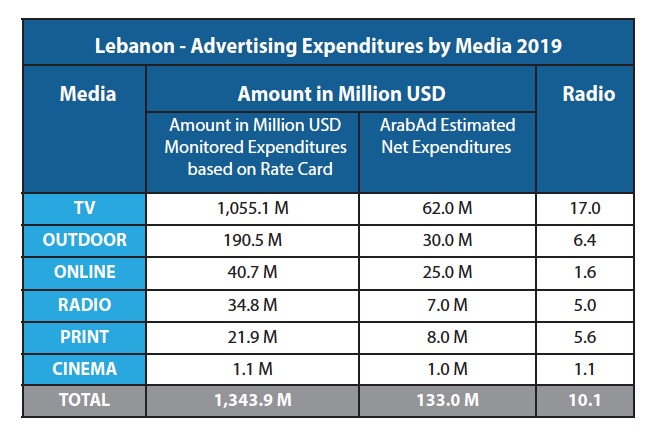

After two hours of discussion and calculations, we managed to dissect the data pertaining to Lebanon’s market and form a precise view of adspend across many platforms to reach a total net of $133 million.

Of course, the only real way to gauge the true extent of regional adspend is for brands to declare their marketing expenditure or for media owners to declare their income from advertising. That is never going to happen. So we need to correct the anomalies that we see every year and provide the industry with a truer picture of regional advertising expenditure as possible.

I believe we’ve taken a step in the right direction this year. This initiative was the first positive step towards providing a better assessment of advertising spend. It was also a step towards a comprehensive analysis of the data available to us. And with reliable and accurate data we have the power to stimulate growth, because such data provides confidence and clarity.

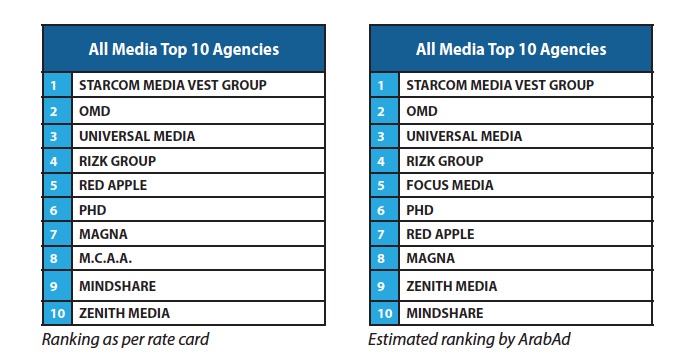

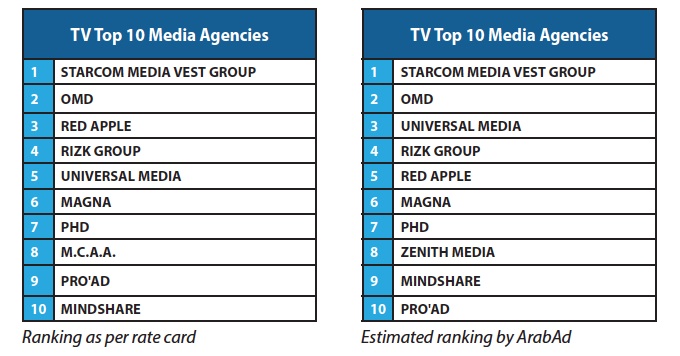

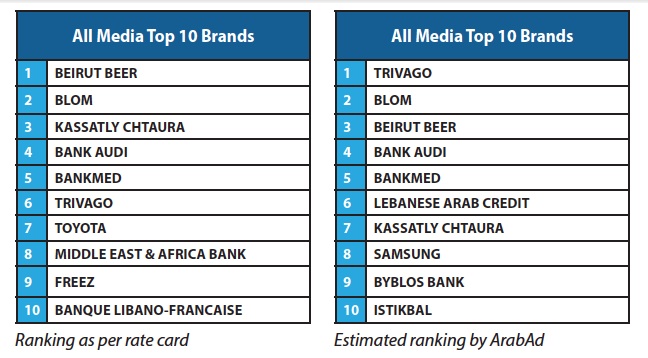

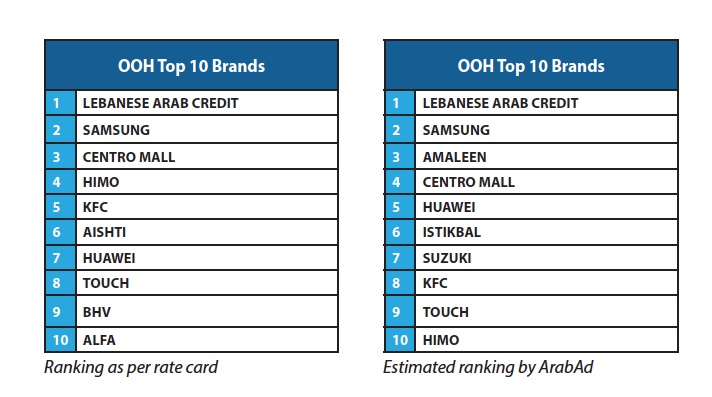

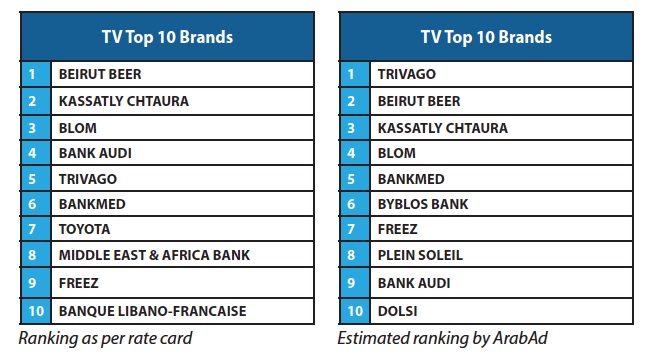

You will find below tables showing the ad spend for Lebanon along with the top 10 rankings of brands and agencies as per rate card and estimated figures. It is accompanied by an analysis of Ipsos’ Juliana Barouk.

ArabAd aims to apply next year the same exercise to the GCC with hope that all stakeholders will welcome the initiative.

LEBANON AD SPEND AND TOP 10 PERFORMERS 2019

'Advertising expenditures in Lebanon are the most inflated in the MENA region, and this is mainly due as we always say to the lack of transparency in pricing the rate cards, explains Juliana Barouk of Ipsos Lebanon.

'Since we at Ipsos rely on the official rate cards while monitoring the advertising expenditures, our numbers show a total of around 1.3 Billion USD on total media, while the reality according to ArabAd and Ipsos estimation is 133 Million USD, an estimation that was validated for the first time through a round table organized by ArabAd with the top agencies in Lebanon.

So my analysis will be based on the estimated read numbers not the inflated monitored ones, because all the numbers will be different.

In 2018 also we have done our estimation, and they show that TV dropped from 85 Million USD to 62 millions in 2019, a drop of 37%; OOH witnessed a drop of 60% from 48 million USD in 2018 to 30 Million USD in 2019.

Print had the highest damage, a drop from 20 Million USD to 8 Million in 2019. Radio dropped by 43% from 10 millions to 7, Cinema stayed as is with 1 million USD while Digital increased from 20 millions to 25 millions in 2019. Overall the market in Lebanon had a big drop of 38%.

Looking at the numbers by brand, Trivago is the top spender across all Media.

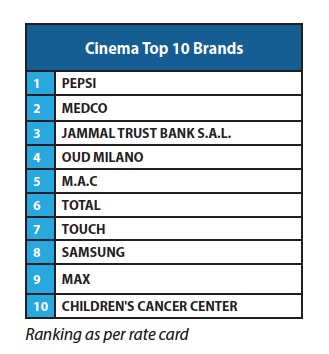

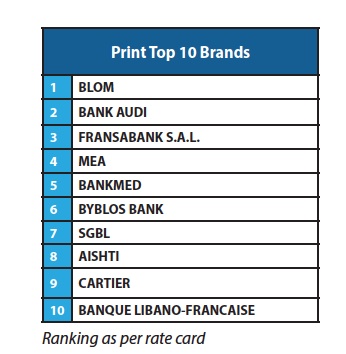

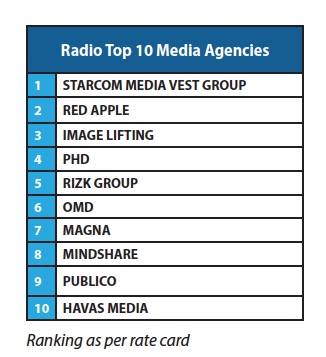

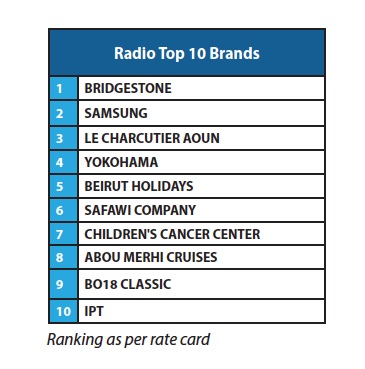

The ranking of the top brands split by media come as follows: Trivago on TV, BLOM Bank in Print, Bridgestone on Radio; in Cinemas, Pepsi and Lebanese Arab Credit on Outdoor.

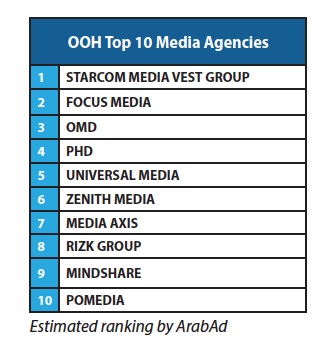

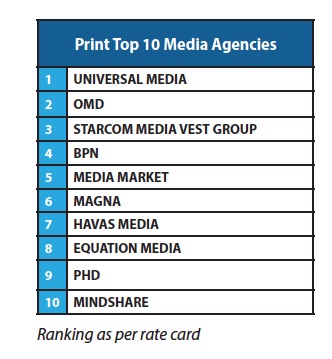

Finally, Starcom Media Vest Group tops the Media Agency ranking this year in Lebanon, followed by OMD, UM and Rizk Group.

Those numbers are also validated by the AA in Lebanon.'

.jpg)