News - Advertising

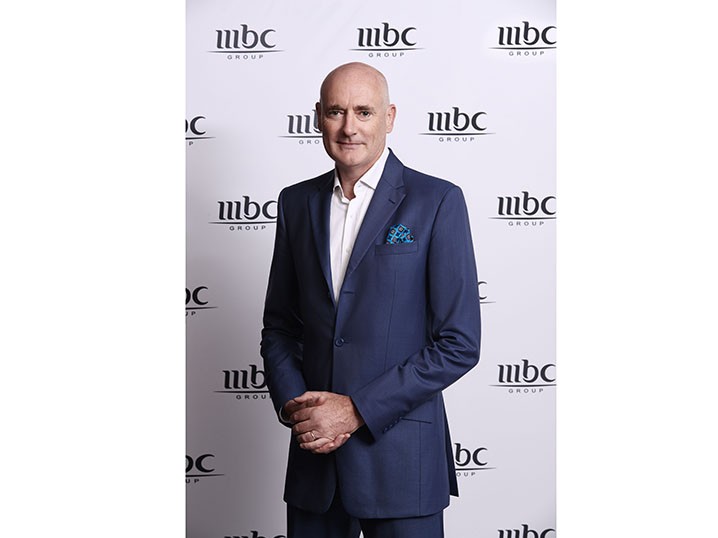

Sam Barnett: ‘We have to be as good as our international competitors’

by Iain Akerman

March 18, 2019

.jpg) Advertisement

Advertisement“2018 was a transitional year for MBC,” admits Sam Barnett, the chief executive of MBC Group. “We had all sorts of issues back at the end of 2017, which were then resolved in Saudi Arabia, but we became clearer on the foundation of the company and on our stability.”

Those issues, of course, were the uncertainty surrounding the ownership of MBC and the detention of the pan-Arab broadcaster’s chairman, Waleed Al Ibrahim, along with scores of other powerful businessmen, princes and officials in what the Saudi government called a crackdown on systematic corruption. Although Al Ibrahim was eventually released, retaining his original 40 per cent share in the MBC Group and both his chairmanship and managerial control, the harm had been done. MBC was in a place of ambiguity.

Now that’s all in the past, says Barnett, who is sitting quietly but confidently in his vast Dubai Media City office. Tall and well-dressed, he may not be the warmest of people to talk to, but he is nevertheless candid and to the point. “We have a new board in place and I think we are in a dramatically stronger place than we were before, because we now have the confidence of the board and we’re getting investment in all sorts of new areas.”

That investment includes MBC Studios, which was launched in September last year and is headed up by Peter Smith, a former president of NBCUniversal International. His remit? To step up MBC’s output of original content for both its linear TV offering and for its video-on-demand platform Shahid. It will do so by building on the work that has already been done by MBC’s existing production units, namely O3 Productions in Dubai, AlSadaf in Saudi Arabia and O3 Medya in Turkey.

“We believe that local content will be critical to the future of television and to the future of our streaming business, and we want to dramatically increase the quality of that local content, particularly drama and film,” says Barnett. “MBC Studios is our tool to do that.”

“The size of the market here has not been sufficient to justify the $1 million or $2 million per episode that you would see elsewhere. And when you’re paying $50,000 an episode on something, it’s different. We are trying to break that mould. And our ambition with creating MBC Studios is that we will do things differently.”

We’ve been here before of course. Like all regional broadcasters, MBC has consistently stated its commitment to the production of quality content. Back in 2013, for example, Ali Jaber, MBC’s group director of TV, said that developing more indigenous Arabic content and moving away from acquired Western formats was a priority, with MBC putting more money than ever into series such as Saraya Abdeen. Yet it has been historically hampered by low budgets and poor production values. And in a world where global TV is better than ever, that’s no longer acceptable.

“It’s a money thing,” says Barnett. “The size of the market here has not been sufficient to justify the $1 million or $2 million per episode that you would see elsewhere. And when you’re paying $50,000 an episode on something, it’s different. We are trying to break that mould. And our ambition with creating MBC Studios is that we will do things differently. I think it’s a bold move by saying we will go for bigger budgets and higher quality and we’ll amortise that cost by getting global distribution on top of what we do in the Arab world.”

“The reason we brought in international people with experience on developing content that works in international markets – and Pete has recently hired a distribution team that is used to selling content globally – is that we [not only] reckon there are many Arab stories which are waiting to be told and that will both push our television and video-on-demand, but [that] we will also get international distribution on them,” he adds. “So, it is absolutely intentional to make them commercial, otherwise we wouldn’t do it.”

The nature of that potential international distribution is only loosely defined as ‘different broadcasters and platforms’, but Arabic-language TV has not traditionally travelled well. Its Achilles heel has often been scriptwriting, which Jaber in the past has criticised, but MBC will also have to overcome years of made-for-TV thinking, and all that that has historically entailed.

“That’s why we’ve made an interesting hire with Pete,” says Barnett. “Because in his days at NBCUniversal it was all about commercial content and international distribution. He’s done 25 years of picking out things, which do work. That’s our aim. We’re not looking to make arthouse movies here. We want things which will work commercially.”

Underpinning the group’s strategy is not only a belief in the transformative power of higher quality local content, but in TV itself. We are, says Barnett, in a golden age of investment globally, but one in which curated content is still valued. As such, MBC’s new productions will not only feed into traditional TV, but into the group’s video-on-demand platforms, with it prioritising its digital services via a ‘robust investment strategy’ over the next five years.

“If you look at TV internationally, it’s robust, it’s still the dominant way of getting to a mass market very quickly.”

MBC hopes its focus on digital will deliver comprehensive growth for both Shahid and Shahid Plus as the group roles out original productions, global content acquisitions, and invests in both product and technology. Such a strategy is understandable in a world where Netflix has overthrown TV’s old business model and has the potential to become MBC’s biggest competitor.

Leading this growth will be Johannes Larcher, who was brought onboard in January as managing director of MBC’s digital and video-on-demand services, bringing with him years of experience from the likes of Hulu, where he was senior vice president of international. “We’re currently going through a business planning exercise with him [Larcher], but with the ambition of significant growth,” says Barnett. “You’ll see a big increase in content, not only from MBC Studios, but also acquired. But we’re also doubling down on our technical investment.”

Barnett believes there’s still “significant growth in digital video advertising”, despite advertising being weak overall last year. Furthermore, “when the economy comes back, TV will also be strong”.

“I mean, if you look at TV internationally, it’s robust, it’s still the dominant way of getting to a mass market very quickly,” he says. “And you have macroeconomic difficulties here combined with a lack of research. Now, the breakthrough has been in just the last few weeks. Under the guidance of GCAM (General Commission for Audiovisual Media), the Saudi regulator, and their work with an industry board, I’m confident that we will see people meters implemented.”

We’ve been here before, too. The UAE, after years of lobbing for people meters, saw the launch of TView in 2011, only for it to be closed in 2016 following years of disagreements over what constitutes an internationally accepted TV ratings currency. What will make this any different?

“The issue has always been, can you get everybody in the industry engaged in the project so that people are in it rather than outside it chucking stones at it,” says Barnett. “And what GCAM has managed to do is bring together an industry board of all the main broadcasters, the agencies, and a representation of advertisers, and they have been through a process with all the due diligence and we’re coming to the conclusion of that [process]. So one is confident that people meters will be in place. That was a big hole in the region in terms of advertising. I see that will be fixed.”

Then there’s MBC Iraq, which was launched in mid-February as part of the group’s five-year vision to expand and grow its offerings throughout the region. It was the first country specific channel to be rolled out by MBC since MBC Masr in 2012. Such channels, however, are an expensive strategy, as Barnett himself has previously admitted, but the belief is that Iraq is ripe for the picking. That means advertising dollars, and with advertising revenue comes the ability to create better quality local content and to launch more country specific channels, particularly in North Africa.

Of all the developments, however, perhaps the most significant is the step change in MBC’s thinking. Whereas once it was okay with being a big fish in a small pond, that is now changing.

“In the past we had been, I’ll not say content, but we’d been happy to be a very good regional player, and it’s clear that in the future everything that happens in this building has to be as good as our international competitors,” says Barnett. “So there’s a lot of change going on at the moment to make ourselves build that strong foundation.”—

.jpg)

.jpg)