News - Digital/Tech

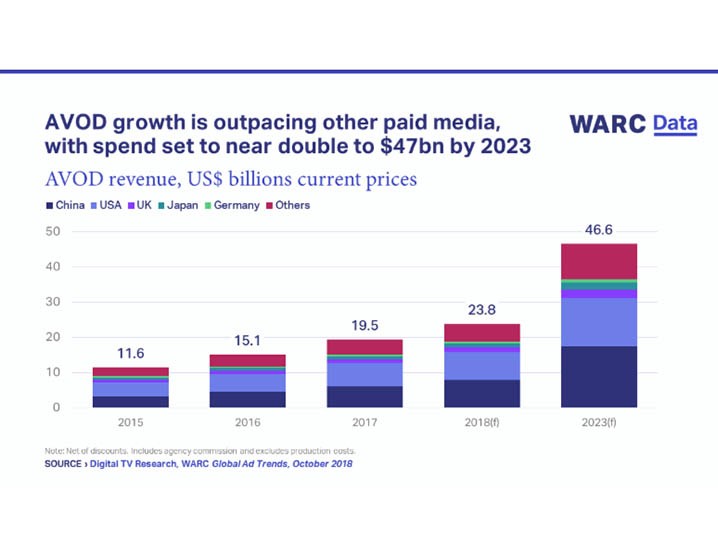

AVOD growth is outpacing other paid media, with spend set to near double to $47bn by 2023

October 25, 2018

AVOD growth is outpacing other paid media - spend is projected to near double to $47bn by 2023 with China and US leading the way

Data from Digital TV Research, based on 138 countries, place the value of the OTT market at $68.7bn this year - a rise of 29% from the $53.3bn invested in 2017.

Just over a third (34.7%) - $23.8bn - of this year's OTT total is expected to be invested by advertisers across AVOD platforms, such as Hulu, HBO Now, and Sony's Crackle.

China is expected to overtake the US to become the world's largest AVOD market for the first time this year, drawing $8bn of advertiser spend - a third of the global total. AVOD in the US is expected to attract just under this, at $7.9bn.

AVOD is still nascent: the expected $23.8bn in brand investment equates to a 5.2% share of global adspend this year (up from 4.5% in 2017 and 3.7% in 2016). But when compared with data in WARC's International Ad Forecast, AVOD expenditure is seen to be growing ahead of other paid media, with the market's value near doubling to $46.6bn by 2023.

One-third of US OTT households do not subscribe to pay TV; 18% have cut the cord

59.5m US homes used OTT in April 2018, up 17% year-on-year according to data from comScore - the equivalent to almost two-thirds (63.5%) of all Wi-Fi enabled homes in the country.

A third of US OTT households are now "cordless", meaning they do not hold a paid cable or satellite subscription. A full 18% are "cord-cutters" - homes which once held a pay TV subscription but have left in favour of OTT - while 14% have never held a pay TV subscription.

Consumers' growing appetite for streaming video across devices is impacting advertising strategies

Rising internet penetration, connection speed, and device ownership is enabling more varied viewing. Whilst delivering convenience for consumers, this is adding complexity and technological challenges for marketers as the media landscape is being disrupted.

As advertisers are being forced to adapt their video campaign strategies, cross-channel fragmentation is challenging the creative and media buying process. The wide array of publisher specs, insufficient lead time required to track down all creative assets and a lack of standardised measurement when buying cross-channel audience-based inventory are cited as major concerns.

As a result, OTT is not currently front of mind when building media strategies; just a quarter (26%) of US CMOs regard OTT as either very or extremely important to their plans.

Summing up, James McDonald, Data Editor, WARC, says: "Consumers' voracious appetite for video content anywhere, on any device, has been propelled by SVOD services such as Netflix. But it is AVOD platforms which present the opportunity for advertisers to marry rich consumer data with pinpoint targeting during engaging content.

"This is why AT&T and Amazon are exploring moves into the AVOD sector next year, with the ultimate aim of taking the lion's share of a market expected to be worth $47bn by 2023."

Global media analysis: A round-up of OTT

• 11% creative repeated once or more during a full-episode delivered via OTT

• 14.3% five-year compound annual growth rate for AVOD adspend globally, to $46.6bn by 2023

• 18% US OTT households who have 'cut the cord'

• 41% premium online video ad impressions delivered via OTT

• 64% Wi-Fi enabled US households with OTT (59.5m)

• 81% consumers who say it is important that they can watch TV programmes whenever they want

Other new key media intelligence on WARC Data

• Successful high-budget campaigns overspend on TV

• Martech efficiency gains may be leading to reduced media spend

• The top Facebook advertisers allocate less to TV

• Fewer than half of Americans trust social media with their data

Global Ad Trends is part of WARC Data, a dedicated online service featuring current advertising benchmarks, data points, ad trends and user-generated expanded databases.

Aimed at media and brand owners, market analysts, media, advertising and research agencies as well as academics, WARC Data provides current advertising and media information, hard facts and figures - essential market intelligence for ad industry related business, strategy and planning required in any decision making process.