News - Digital/Tech

Baby Boomers’ shift to digital content accelerates but brands are failing to keep up, finds WARC in new report

October 11, 2024

.jpg) Advertisement

AdvertisementBaby Boomers are the world’s wealthiest generation, however, brands are failing to keep up with their increasingly digital media habits, according to WARC Media’s latest Global Advertising Trends report, ‘Baby Boomers’ big digital shift’, released on October 9.

Baby Boomers, defined for this report as adults born between 1946 and 1964, i.e. those aged between 60 and 78 today, do not spend ever-greater amounts of time on social platforms. Instead, older generations are switching from offline versions of content media to their online extensions – be it connected TV or online press.

This matters to marketers, because these formats are traded and measured differently, requiring a fresh approach to media planning.

Alex Brownsell, Head of Content, WARC Media, says: “Boomers are embracing digital content. While brands obsess over Gen Z, the affluent Baby Boomer generation is undergoing a media revolution. This requires advertisers to revisit long-held assumptions, and ensure digital media plans are tailored to older consumers’ increasingly unique habits.”

WARC’s Global Advertising Trends: ‘Baby Boomers’ big digital shift’ report, outlines key considerations for brands wanting to tap into this generation:

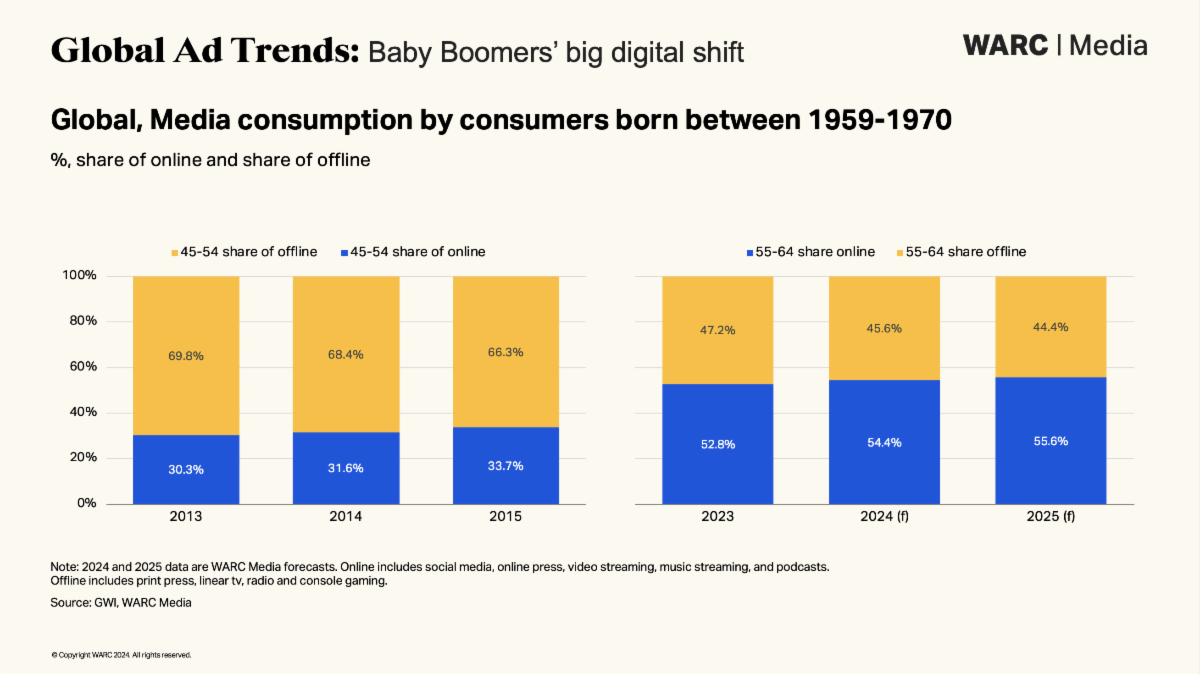

Baby Boomers’ shift to digital content accelerates: In 2024, over-55s globally will spend more than half (54.4%) of their media time online

Marketers are in thrall to Gen Z. This may obscure substantial changes in media behaviour among older audiences.

Boomers’ media preferences are quickly evolving. According to GWI, in 2024, over-55s globally will spend more than half (54.4%) of their media time with online media – including digital components of traditional channels (e.g. connected TV, digital audio and online press) – up from 47.0% in 2020.

WARC Media compared media consumption behaviour among 45-54s a decade ago with today’s 55-64s – representing those born between 1959 and 1970. In 2013, less than a third (31.6%) of all media time was spent with digital channels; in a decade, that share has grown by more than 20 percentage points to 53% in 2023, propelled largely by behaviour changes brought on by COVID.

Social media remains appointment viewing for Boomers: US consumption for 55-64s on social media is up 43.1% compared to TV streaming, up 195%

Paul Bland, Chief Digital Officer, Havas Media Network, says: “Media planners must ditch their habit of seeing Baby Boomers as living in a kind of media “statis”. If anything, older people are probably rising the most in terms of consumption of some of the most innovative digital properties around. It's genuinely impacting the way we buy media as an agency.”

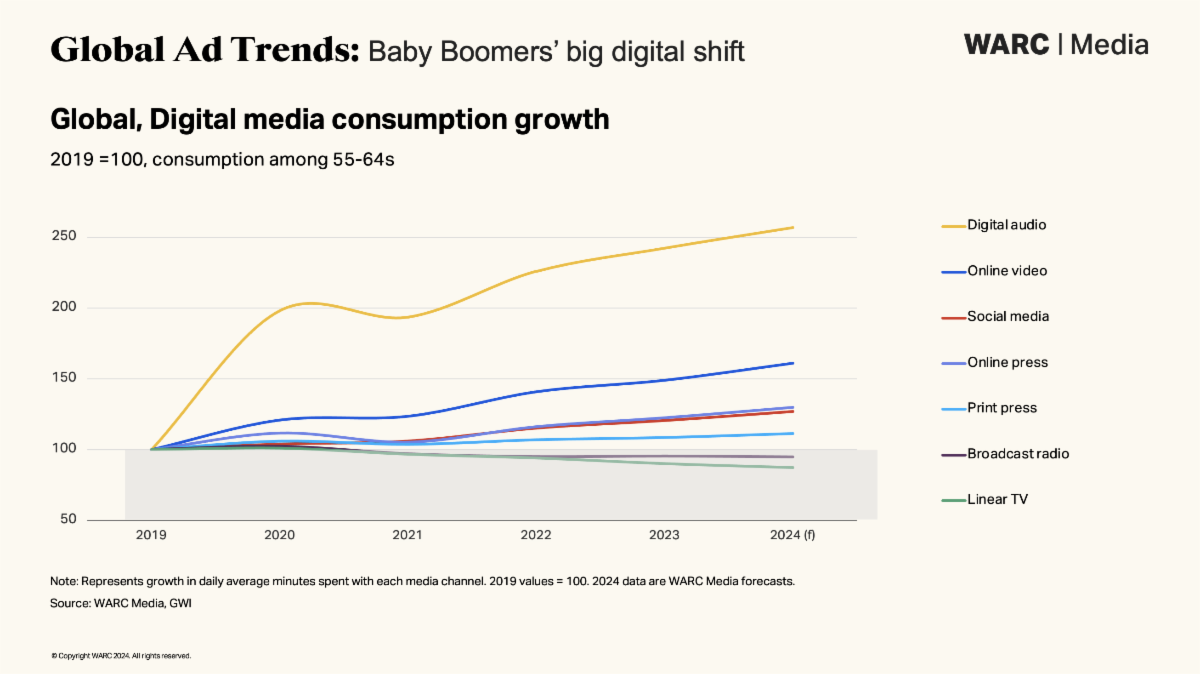

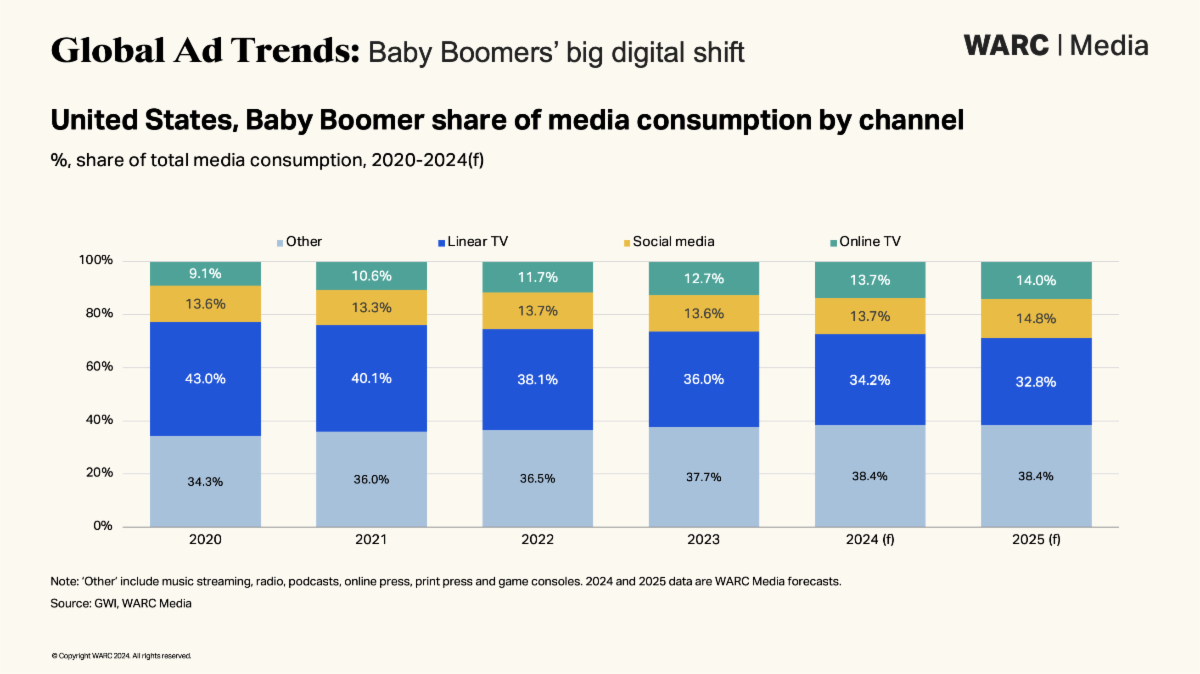

Baby Boomers are building digital media experiences distinct from younger audiences. While Baby Boomers are spending a little more time on social platforms, it remains a small part of their overall media habits.

By next year, 55-64s in the US are forecast to spend 93 daily average minutes with social media, per GWI, up 43.1% on the 65 minutes of consumption recorded among 45-54s in 2015. However, other areas of digital consumption are growing much faster: online TV streaming is up 195.0% over the same period, with Baby Boomers switching to Netflix and YouTube on their TV screens.

Facebook continues to be older consumers’ preferred network. According to YouGov, Baby Boomers make up the largest chunk (29%) of weekly Facebook users in the US, compared to only 9% of those accessing TikTok each week.

In the UK, social media consumption has largely plateaued among the 55+ audience, with average daily minutes falling from 58.3 in 2015 to 52.2 last year. Highly mobile-penetrated China leads on time spent with social media each day, but there too Baby Boomer usage has ebbed in recent years.

Baby Boomers are least receptive to advertising: Only 12% globally feel ‘positive’ about advertising

Baby Boomers have the lowest average levels of ad receptivity in a cross-generation comparison. Only 12% globally say that they feel ‘positive’ about advertising, significantly below the 47% benchmark for all consumers.

Gonca Bubani, Global Thought Leadership Director – Media, Kantar, says: “Baby Boomers are generally just more negative about ads compared to the other generations we measured. As advertising receptivity goes up for everyone, they are on the lower end, and they remain there.”

Only 4.5% of Baby Boomers have downgraded to an advertising funded subscription video on demand (SVOD) tier on services like Netflix and Disney+, according to GWI, compared to more than a quarter (28.4%) of Gen Z respondents.

Rising advertising loads on TV have frustrated older audiences, but they appear more positive about newer social and video platforms, with TikTok ranked as their preferred option. This may be a result of having joined the app more recently and not experiencing it in its earlier, ad-lighter days.

.jpg)