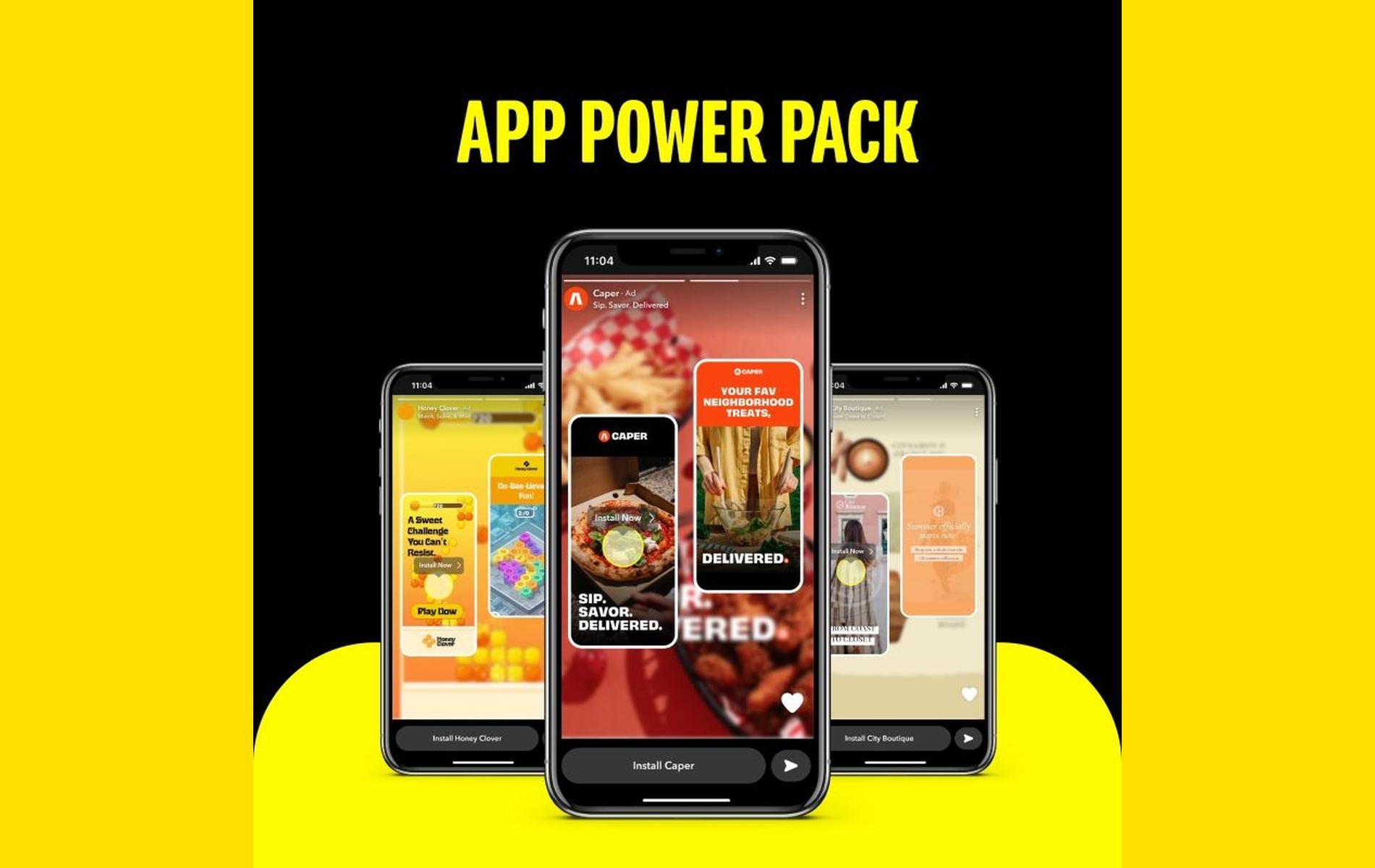

News - News In Brief

GfK’s Consumer Outlook Report 2024 reveals key insights into UAE consumer behavior and priorities

May 14, 2024

.jpg) Advertisement

AdvertisementGfK, a global market and consumer intelligence company, recently conducted an extensive Global Consumer Outlook Report 2024, unveiling invaluable insights into the concerns, preferences, and habits of consumers in the United Arab Emirates (UAE).

The study sheds light on the top concerns of UAE consumers and explores critical trends and insights that shape the consumer landscape, delivering invaluable data and analysis for businesses and stakeholders worldwide.

According to Nacho San Martin, Vice President, T&D EEMEA (Eastern Europe Middle East And Africa), “The Consumer Outlook Report 2024 provides valuable insights into the concerns, preferences, and habits of UAE consumers. Brands and companies in the UAE can leverage these findings to better understand and cater to the evolving needs and expectations of their target audience. By aligning their offerings with the identified trends and values, businesses can establish meaningful connections, drive customer satisfaction, and foster long-term loyalty.”

GfK will unveil the Global Consumer Outlook Report 2024 at its upcoming 4th edition of the NIQ and GfK Insight Summit on 22nd May wherein industry stalwarts like Hatem Dowidar, Group CEO at e& Group, Michael Chalhoub, President Strategy, Growth & Innovation at Chalhoub Group, Nilesh Khalkho, Group CEO at Sharaf DG and many more.

Key findings from the NIQ Global Consumer Outlook Report:

- Value and Volume Slowdown: In November 2023, prices rose by 6.1%, a significant drop from the 13.6% increase observed in January 2023. As inflation decelerates, it reveals that the slowed growth in sales value no longer masks low or declining consumption rates. Retailers and brands must strategically respond to avert excessive promotions and safeguard the bottom line.

- Consumers Under Pressure: Today, 34% of global consumers feel worse off financially than a year ago, as the unemployment rate remains steady and wages lag inflation. As the global crisis remains top-of-mind, expect increased competition for a smaller share of consumer spending.

- Proactive and Precise with Wellness: 40% of global consumers proactively prioritize their health, contributing to a growth niche in the market. Recognizing the significance of proactive health management, consumers are keen on specific lifestyle changes and product features to attain their health goals.

- Hybrid Views on Value: In a custom analysis across different price tiers, value-priced products were the only group to see sales share growth (0.6 pts) in 2023. Financial polarization between affluent and vulnerable consumers drives an expanded search for value options, and retailers and manufacturers should anticipate demand for new affordable product assortments in 2024.

- Value-focused Innovation Growth: Manufacturers that innovate are 1.8 times more likely to boost overall sales. Continuous innovation has proven most advantageous for companies amid market slowdowns. Innovation isn't limited to premium positioning; companies must pursue value-driven initiatives to thrive.

- Fluid Channel Dynamics: 11% of global consumers report shopping through social media channels. As the retail landscape evolves, adapting to changing patterns in how consumers explore, experiment with, and purchase products is crucial.

.jpg)

_copy.jpg)