News - News In Brief

TPAY Mobile and Vodafone Egypt launch Digital Payment on Google Play

May 4, 2020

.jpg) Advertisement

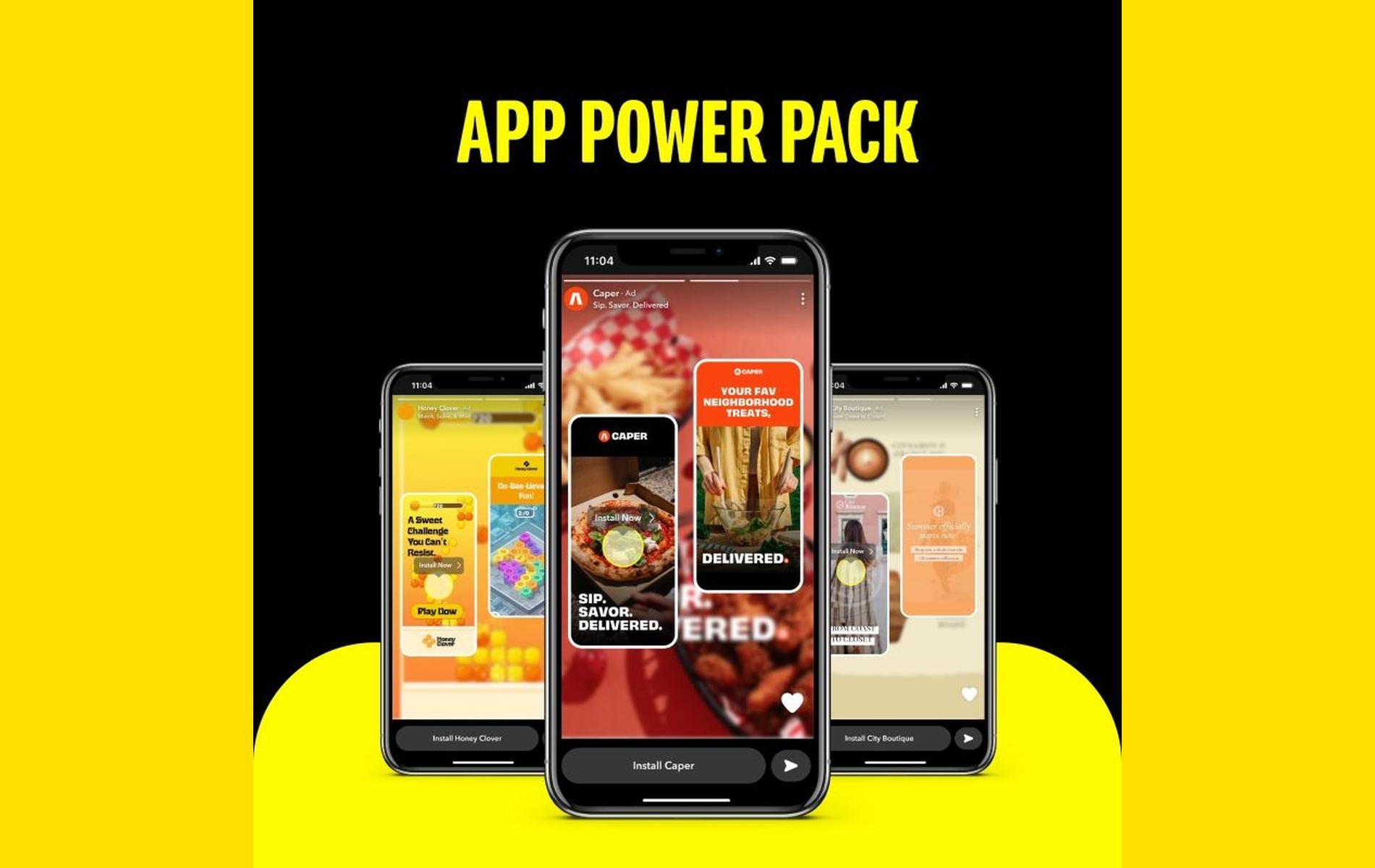

AdvertisementVodafone Egypt, the largest mobile network operator in Egypt in terms of active subscribers and TPAY MOBILE, the leading digital payment enabler in the Middle East and Africa, have launched today Direct Carrier Billing (DCB) on the Google Play store. Through this partnership TPAY MOBILE, which operates in the UAE, Egypt, Saudi Arabia, in addition to seven other countries, enables Vodafone Egypt subscribers to purchase from Google Play and conveniently charge the payments to their mobile phone bill or deduct them from their airtime balance. For the first time in Egypt, all of the 41 million Vodafone subscribers have the option to purchase paid apps, games and in-app content without using credit cards from inside Google Play store in a safe, secure and simple way.

A few months ago, cashless transactions were a convenience for consumers wanting to buy online or in a physical store through their mobile phones, credit cards, or other modes of e-payments. Current realities brought about by the COVID-19 pandemic made cashless payments a necessity, facilitating contactless payment transactions and building another line of defense against the spread of the virus. Some online and offline businesses and retailers are currently opting for new cashless payment methods to keep their employees and customers safe.

Even before the pandemic, Direct Carrier Billing, or DCB, was becoming an increasingly popular mode of payment particularly for digital services, especially in emerging markets, which are characterized by young populations eager to get online services despite being underserved by the banking sector.

Sahar Salama, Founder and Chief Executive Officer of TPAY MOBILE, stated: “We are committed to provide a seamless, secure, convenient and safe digital payment experience to all our users. Using TPAY MOBILE’s payment platform will help Vodafone Egypt’s customers to make payment transactions from the Google Play store and other digital merchants in a secure and safe way. We are delighted to be able to offer a safe and convenient payment solution to thousands of consumers and retailers in Egypt and the region, and we look forward to work with our partners to continue to set new benchmarks for the sector in Middle East & Africa.”

.jpg)