News - Advertising

MENA's Adex soars with 14 percent surge in 2022 - Telecommunication category leads in spending in region

by Elie Aoun

June 7, 2023

.jpg) Advertisement

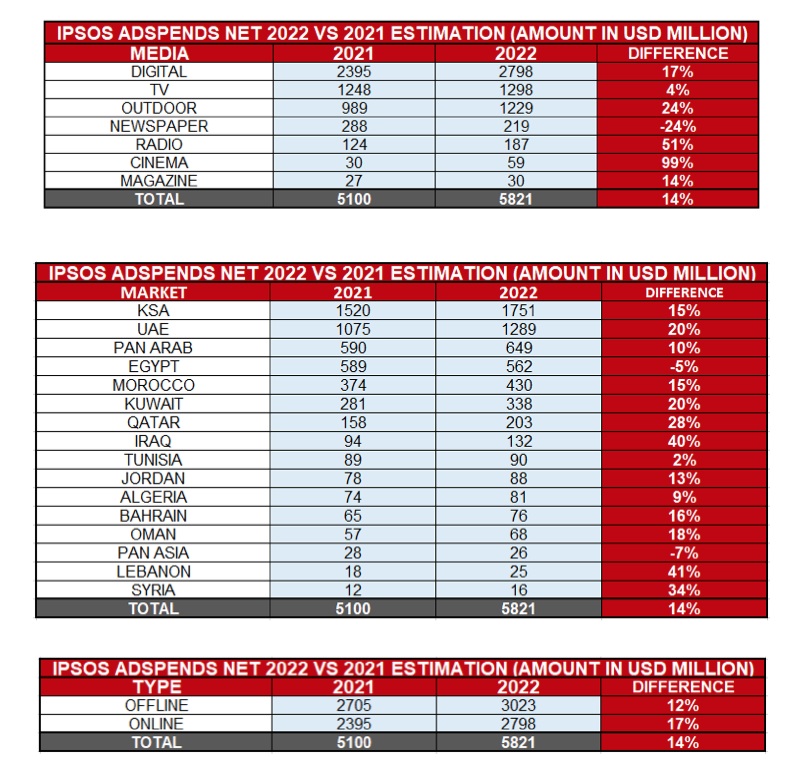

AdvertisementThrough meticulous calculations and in-depth investigations, Ipsos, a trusted authority in market research, estimated a remarkable 14 percent surge in the total ADEX. The expenditure escalated from $5.1 billion in 2021 to an impressive $5.82 billion in 2022. What sets these figures apart is that they are derived from a comprehensive analysis Ipsos undertakes each year, rather than relying on inflated and obscure rate cards.

It is worth noting that official rate cards suggest a total ADEX of approximately $27.7 billion, which is five times higher than the actual reality. Such inflation varies across different media platforms, with television exhibiting the highest inflation rate and digital advertising experiencing the lowest.

By MEDIA

Looking at the numbers by media, Digital media is having a very strong lead, with a jump from 2.4 Billion USD in 2021 to close to 2.80 Billion USD in 2022, an increase of 17%, with a market share of around 48%, so now in MENA, half of the expenditures is coming from the digital media, in all its platforms.

Television media managed to maintain its position as the second-largest segment, recording a modest 4 percent increase from $1.25 billion in 2021 to $1.3 billion in 2022. The growth in television media was largely fuelled by the highly anticipated football World Cup event broadcasted on beIN Sports in 2022. However, television media faces fierce competition from the rapidly growing out-of-home (OOH) media sector, which has been gaining popularity among agencies and advertisers in the region.

OOH media experienced a substantial 24 percent increase, surging from $989 million in 2021 to nearly $1.2 billion in 2022, driven primarily by Saudi Arabia (KSA) and the United Arab Emirates (UAE).

In contrast, newspaper media continued to struggle, witnessing a significant decline of 24 percent from $288 million to $219 million.

On the other hand, radio, especially in the UAE, made an impressive comeback, achieving a remarkable 51 percent increase in expenditures from $124 million to $187 million in 2022.

Meanwhile, the magazine media sector remained relatively small, with only minor increases observed in a few countries.

By COUNTRY

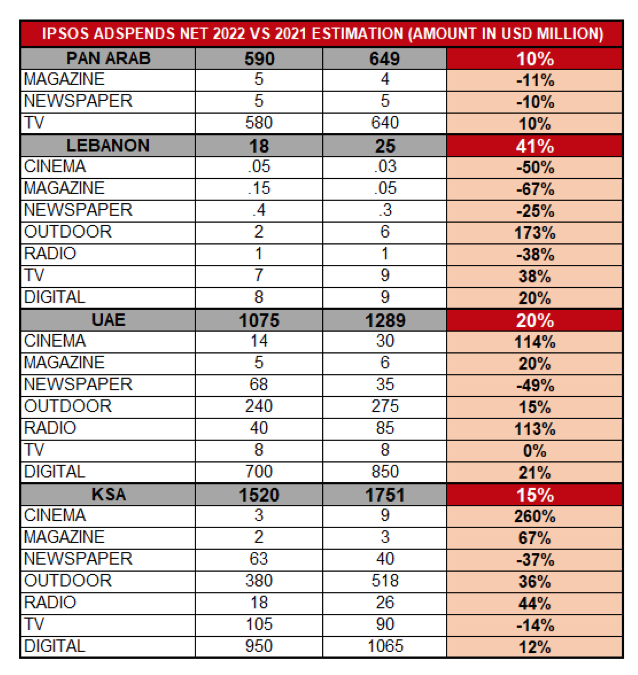

When examining advertising expenditures by country, we observe significant variations.

Leading the pack is KSA, benefiting from substantial investments in digital and out-of-home (OOH) advertising.

Their expenditure surged from $1.52 billion in 2021 to $1.75 billion in 2022, representing a remarkable 15 percent growth.

Following closely is the UAE, boasting a dynamic market with significant investments in digital, OOH, and radio advertising. Notably, the UAE’s radio market alone accounts for nearly half of the region’s total radio spending. In 2022, the UAE witnessed a 20 percent year-on-year increase, rising from $1.07 billion to almost $1.3 billion.

The Pan Arab market secures the third spot, housing most of the major stations and experiencing a 10 percent surge in advertising expenditure, primarily driven by the World Cup event. Their spending increased from $590 million to $649 million. It’s important to note that digital advertising is allocated on a per-market basis, with no publishers operating at the Pan Arab level, as ads are served specifically to each market.

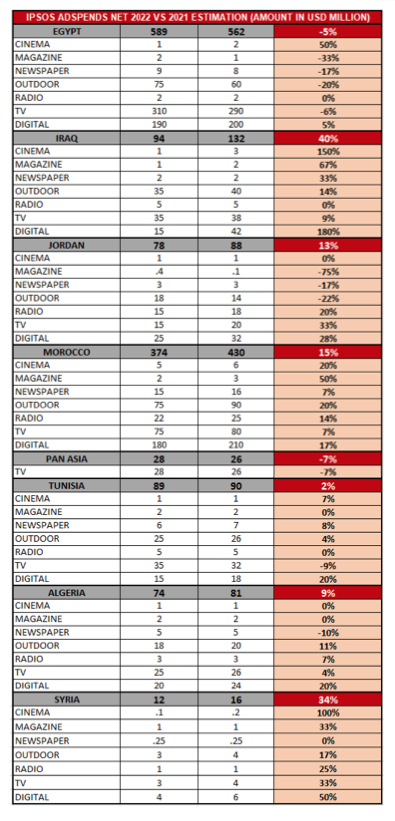

Egypt holds the fourth position as a significant market, despite a 5 percent decrease in advertising expenditure between 2021 and 2022. This decline can be attributed to the devaluation of the Egyptian pound.

On the other hand, Morocco, known for its regulated market, witnessed a noteworthy 15 percent increase, reaching $430 million from $374 million.

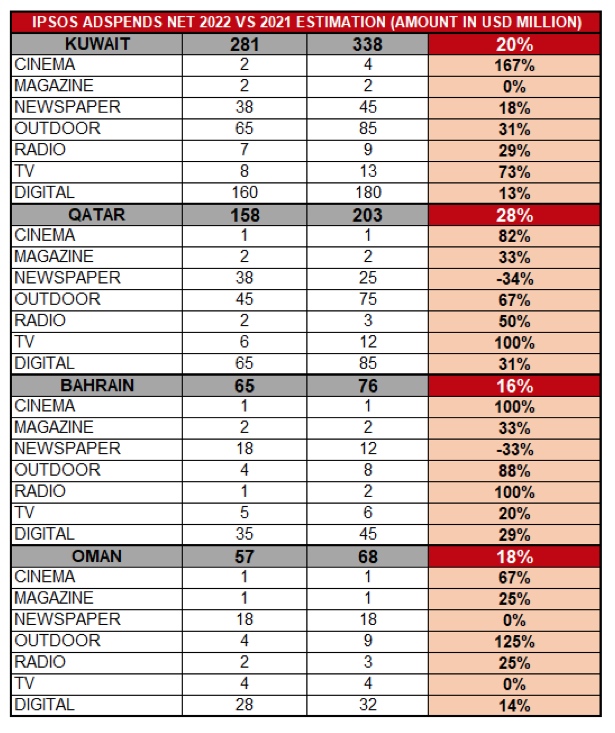

Moving on, Kuwait ranks sixth, experiencing a solid 20 percent increase, followed by Qatar, which greatly benefitted from the World Cup event, resulting in an impressive 28 percent growth. The Iraqi market shows promise, with a total advertising expenditure of $132 million and a remarkable growth rate of 40 percent.

In 2022, Tunisia, Jordan, Algeria, Bahrain, Oman, PAN Asia, and Lebanon all showed positive growth, marking a strong comeback after the challenging years of 2020 and 2021. Collectively, these markets reached a total advertising expenditure of $428 million.

Conversely, Syria represents the smallest market with various challenges to overcome.

TOP SPENDERS IN MENA

The question arises: Who are the leading spenders in the MENA region across all media? Taking the lead is the Food sector in terms of advertising expenditure, followed by telecommunication, hygiene and beauty care, property and building, and entertainment and leisure, in that order.

Delving further into the specifics, the telecommunication category takes the first position, followed by Real Estate, banking, chocolate, and soft drinks. A closer analysis reveals that Etisalat holds the top position as the biggest spender in the region, trailed by Vodafone, Coca Cola, Kinder, and the National Bank of Qatar. As for the overall top advertisers in the MENA region across all media, Unilever takes the lead, followed by Procter and Gamble, Etisalat, PepsiCo, and Ferrero. While these are the top five advertisers, the ranking varies across media and countries, and the tables provided include rankings up to the top ten.

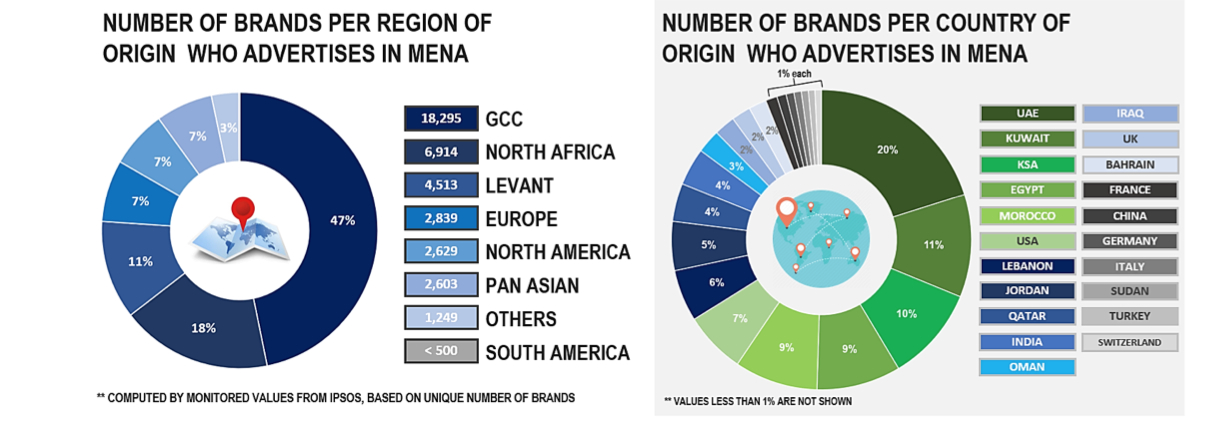

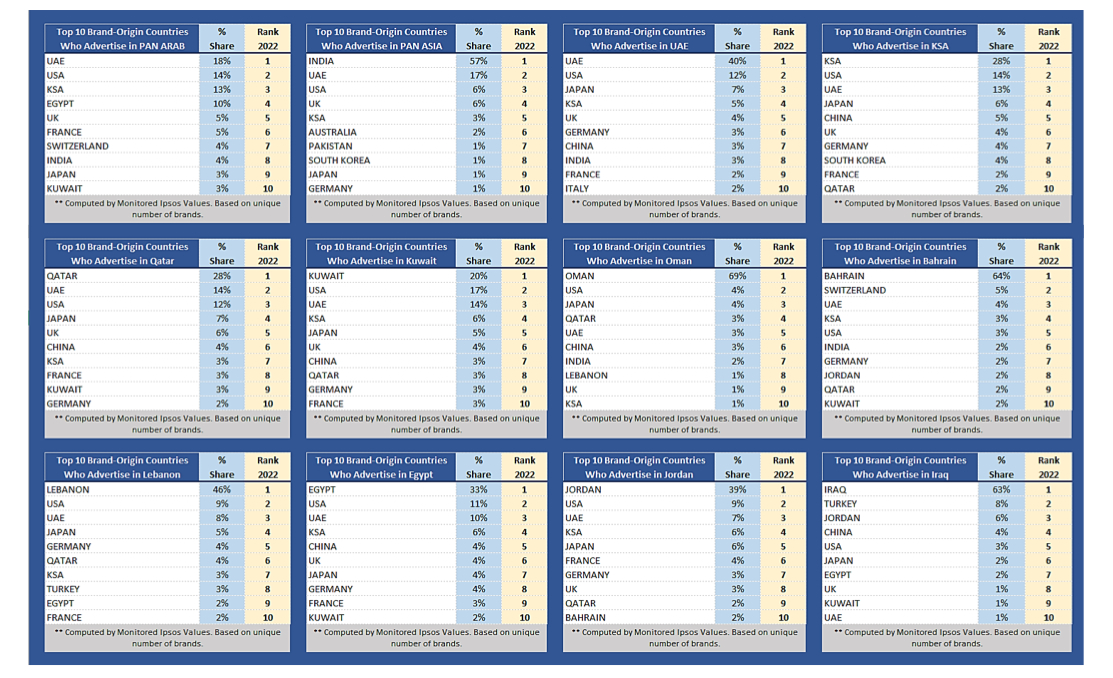

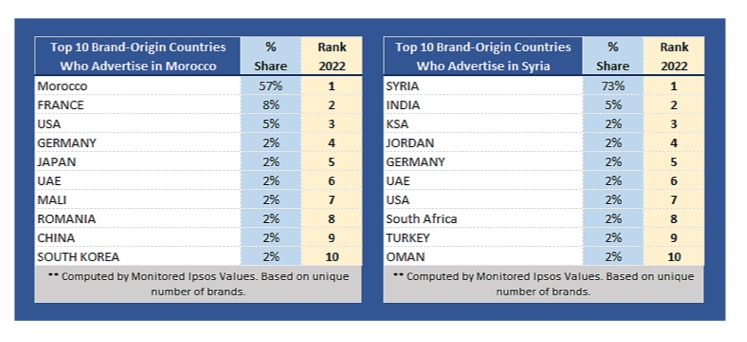

BRANDS’ COUNTRY OF ORIGIN

Among the new analyses we have decided to publish this year is the examination of the brand’s country of origin, an exercise that required significant time investment but yields valuable insights. This analysis helps us understand which countries each brand originates from and where they advertise in different markets. The results reveal some intriguing facts. When considering all media, both digital and traditional, in the MENA region, it is surprising to note that 20 percent of the advertising brands are from the UAE. This finding reflects the UAE’s active promotion of its various Emirates and products.

Equally surprising is the revelation that the second country with the highest representation, accounting for 11 percent of the total brands advertising, is Kuwait. Following closely with the same percentage is the Kingdom of Saudi Arabia (KSA), succeeded by Egypt, Morocco, and the USA.

Examining the numbers on a country-by-country basis, we find that local brands consistently dominate in their respective countries, with notable presence from international countries such as the USA, Switzerland, Turkey, and others. These insightful analyses are being published for the first time, and it may be worthwhile to consider a separate article dedicated to further exploring these findings in the future.

This is a brief overview, highlighting key observations for the year 2022:

Digital media has emerged as the clear leader in our region. It is widely used by top brands and also offers affordability to small and local brands unlike other mass media. In my opinion, the growth of digital media will continue. However, a significant drawback is that a large portion, around 85 percent or more, of the total spending is dominated by a few global companies. This situation does not benefit the local economies, while numerous local platforms struggle for the remaining 15 percent.

Television, once the dominant media in our region, has lost its prominence. While there might be some growth in the coming years, it will never return to its golden era when billions of dollars were invested in it. In my personal view, this decline can be attributed to the short-term vision of some players and the price wars among competitors.

Out-of-Home (OOH) media shows great promise and is undergoing a transformation towards digital platforms.

It will continue to grow, and its share of the overall advertising landscape is notably larger than international norms.

Print media will continue to face challenges, leading to the closure of many outlets.

Radio, a media platform with high potential in our region, is often underestimated by its own players and has been negatively impacted by price wars. However, with effective management, radio can experience exponential growth, particularly in countries like KSA, Egypt, and others. The UAE serves as a prime example of well-managed radio businesses.

Lastly, cinema is expected to experience slight growth with the introduction of new cinema screens in KSA.

However, it will struggle due to the lack of local content that resonates with the local viewership.

.jpg)

.jpg)