News - Digital/Tech

Lebanon, a digital dream?

by Iain Akerman

October 28, 2019

.jpg) Advertisement

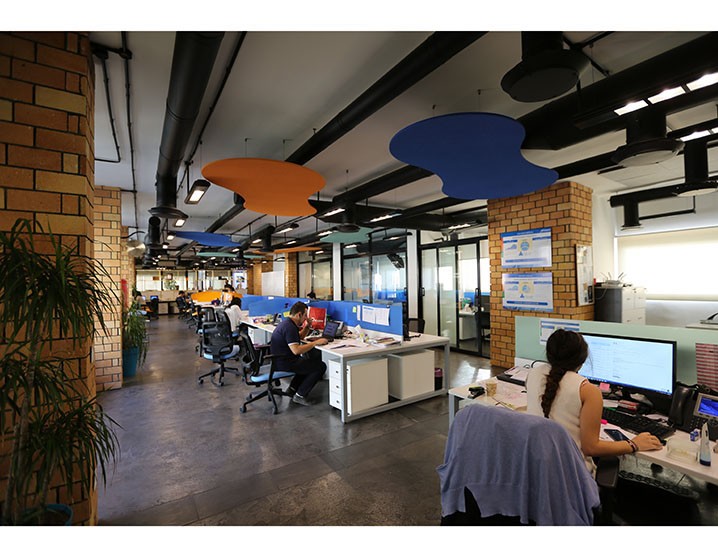

AdvertisementSomething positive is happening in Lebanon. Over the course of the past few years Beirut has been steadily building its reputation as a digital hub, buoyed by the country’s entrepreneurial skills and innovation clusters such as Beirut Digital District. Such has been its success that there is even talk of Beirut regaining some of its regional importance, not only in terms of its people, but as a centre of digital excellence. Given the wider troubles of the country – and of the advertising and media industry as a whole – such talk can only be welcomed.

Expat talent is returning, the demand for digital marketing services is on the rise, and a liberal investment climate is contributing to an improved digital ecosystem. In the midst of all this an increasing number of agencies are concentrating their digital teams in Lebanon, refocussing on Beirut and reducing reliance on Dubai.

Fawzi Rahal, managing director of Flat6Labs Beirut, a regional start-up accelerator, believes at least half of the digital agencies based in Dubai have their production teams in Beirut, while the bigger networks are beefing up their digital operations in Lebanon. Why? Cost is one reason. Compared with cities across the Gulf, Beirut is cheaper not only in terms of salaries, but in terms of overall operational expense. A fact that has only been accentuated by the region’s recent economic downturn.

“On average, operational overheads in Dubai are two times that of Beirut. With that in mind, it makes financial sense to shift focus to Lebanon as a primary production and talent market…”--Fawzi Rahal, managing director of Flat6Labs Beirut

“The financial recession has put pressure on marketing and content companies to optimise cost,” says Rahal. “On average, operational overheads in Dubai are two times that of Beirut. With that in mind, it makes financial sense to shift focus to Lebanon as a primary production and talent market in order to reduce operational cost and consolidate regional production teams in Beirut. This could lead to an increasingly irreversible move that could potentially tip the balance to Beirut’s advantage; this does not mean that an exodus of agencies and brands from Dubai is about to take place – the agencies and marketers paying the bills will remain Dubai-based, but it will create a much more competitive market, with entities that have a Beirut office being able to offer comparable quality at lower rates.”

Wunderman Thompson’s digital agency Mirum is headquartered in Beirut, and although Impact BBDO’s main digital hub remains in Dubai, it is expanding its Beirut team to service both the network and increasing demand in Lebanon. “We started developing the team more than a year ago but we are now growing at an exponential rate considering the increased demand,” says Emile Tabanji, Impact BBDO’s managing director for Lebanon and the agency’s chief operating officer for Egypt. “The Beirut team’s main focus will be on digital and motion design, data analytics, and content production, while other disciplines will be more Dubai led.”

“We are now growing our digital force at an exponential rate considering the increased demand.”--Emile Tabanji, Impact BBDO’s managing director for Lebanon and the agency’s chief operating officer for Egypt

Impact BBDO is far from alone. Publicis Media has located its centre of excellence in Beirut, while the decision to base Omnicom Media Group’s (OMG) Core in Lebanon was taken a couple of years ago. The latter unit supports OMG’s agencies across the region with technical and administrative services, with the decision to set Core in Lebanon largely based on the availability of talent, not cost.

“In our case, it’s not a relocation to a low-cost environment,” says Elda Choucair, chief operating officer at OMG MENA. “If it had been, we would have gone to other places. The choice of Beirut is a conscious decision to capitalise on local talent and the efficiency that we can derive from our set-up. We are not stopping there, and we are expanding this approach beyond Lebanon. We already have teams in Egypt and India serving our agencies in MENA. Our focus is not limited to just digital marketing, as our Beirut operation already demonstrates, and it’s certainly not a case of Dubai versus any other place. It’s not a replacement, it’s an evolution. We never had the intention to create just a digital hub but a new efficient and agile structure to take us into the future.”

“The choice of Beirut is a conscious decision to capitalise on local talent and the efficiency that we can derive from our set-up. “--Elda Choucair, chief operating officer at OMG MENA

The importance of talent cannot be understated. It’s almost a cliche now, but the country’s trilingual students form a national reservoir of talent, many of whom excel in the digital world. Even before the latest boom in the digital ecosystem Beirut was viewed as a production hub for the media and content business, but what alters the narrative today is that reservoir’s relative affordability.

“An array of markets have extended their teams to Beirut after recognising its talent’s capabilities,” says Amer Fouladgar, regional associate director at Publicis Media GDD (Global Distributed Delivery) Hub. “Cutting costs and creating efficiencies as well as consolidating clients’ international performance marketing activity in one location is crucial, but the calibre of talent in Lebanon is the governing factor for the expansion. This is also a double-edged sword as the biggest challenge is retaining such key talent from moving to economically advanced markets offering a better quality of life. Therefore, economic and political stability is vital for Beirut to reach its full potential of being one of the biggest hubs serving the globe.”

“Economic and political stability is vital for Beirut to reach its full potential of being one of the biggest hubs serving the globe.”--Amer Fouladgar, regional associate director at Publicis Media GDD

None of this should be viewed in isolation, of course. Beirut has an impressive array of start-ups, entrepreneurs, accelerators, incubators and venture capitalists, in addition to numerous co-working spaces. All of which contribute to the country’s digital ecosystem. The Lebanese government is also actively working towards building a successful tech scene, says Stephanie Abi Abdallah, programs director at Beirut Digital District (BDD). As far back as 2014, Banque du Liban launched Circular 331, a $400 million initiative designed to boost investment in start-ups. This figure was raised to $650 million in 2016.

“We have a huge number of young and inspiring entrepreneurs, who proved that it is possible to create, innovate and build their ideas locally and then take them internationally.” --Stephanie Abi Abdallah, programs director at Beirut Digital District (BDD)

“We have a huge number of young and inspiring entrepreneurs, who proved that it is possible to create, innovate and build their ideas locally and then take them internationally,” says Abi Abdallah. “From a local perspective, Lebanese start-ups are driven by extremely talented individuals and boast huge potential. According to the GEM (Global Entrepreneurship Monitor) report featured in Forbes and unveiled by the UK Lebanon Tech Hub and the British Embassy in Beirut, Lebanon ranked highest in the MENA region for early stage entrepreneurial activity. In addition, Lebanon has displayed over the past years an exceptionally high number of deals for such a small country and has steadily risen in both number and value of deals.”

Accelerators such as Flat6Labs have played their part. In 2018 alone the company invested in 19 out of the 40 investments that took place in Lebanon. It did so by offering between $30,000 and $50,000 in seed funding, and between $150,000 and $500,000 in early stage funding.

“What would really set Beirut apart from the rest of the MENA region is our ability to aim global due to our anthropological development and the ability to adopt a universal view.”--Abed Agha, chief executive of Vinelab

But before we get ahead of ourselves, let’s not forget the downsides. Talent is finite and often prone to departure, while the cost and speed of the country’s internet is notoriously bad. The slow adoption of ecommerce also remains a significant obstacle to entrepreneurship, just as the country’s economic and political turmoil has the potential to destroy everything that has so far been achieved. Even the basic infrastructure – electricity, roads, public transport – is way below par.

Abi Abdallah rattles off a list of other challenges: minimal research and development; over dependency on Circular 331; a suboptimal regulatory framework with multiple outdated laws; and the lengthy processes required for doing business. “Most of the above challenges require both the private and public sector working hand-in-hand to find optimal solutions,” she says.

Abed Agha, chief executive of Vinelab, a media technology company based in BDD, goes so far as to question whether Beirut can even be classified as a digital hub. “We entered really late in the game when it comes to digital innovation and I see very few organisations bringing digital transformation to their businesses,” he says. “However, communities like BDD were an important catalyst in speeding up the pace and proper collaboration among private sector stakeholders could speed it up further.

“Our ecosystem is still young and needs nurturing.” --Choucrallah Abou Samra, managing director of OMG’s Core

“What will give it an extra push is more imitation of models that already work globally and that solve real problems, and we surely have loads of these problems. What would really set Beirut apart from the rest of the MENA region is our ability to aim global due to our anthropological development and the ability to adopt a universal view.”

“Our ecosystem is still young and needs nurturing,” adds Choucrallah Abou Samra, managing director of OMG’s Core. “By this, I mean investment, infrastructure and regulation. It’s been five years since Banque du Liban released its Circular 331 about funding start-ups. Since then, multiple initiatives have followed in that path. Lebanon now has the fourth largest tech investor community in MENA, according to a report by ArabNet, but more must still be done. In 2018, the number of transactions and their value fell by some 40 per cent.

“The reliability and cost of internet access is another issue, although we’ve been able to mitigate its impact. The network is improving slowly. Ogero is expecting to complete its national fibre optic deployment across Lebanon this year. The price of mobile internet access is also falling across all operators. The regulatory [framework] is slowly getting in place but there is plenty more to be done. There is too much red tape for start-ups. It takes at least one month to register a business in Lebanon, compared to 24 hours in the US.”

Nevertheless, the country is punching above its weight in terms of the number of digital investments and operational start-ups, believes Abou Samra. The regulatory framework governing electronic transactions and personal data has also been strengthened by the passing of Law No 81, while job creation is helping to prevent the much-feared brain drain. BDD, for example, hopes to fuel the growth of over 10,000 “dynamic and creative individuals through smart office spaces, unparalleled infrastructure, and healthy environments, topped off with valuable services”, says Abi Abdallah. “We also aspire to develop self-sustaining innovative neighbourhoods, where technology and brain power seamlessly integrate, allowing for creative communities to flourish.”

All of which points towards an optimistic future. “Budgets are constantly being optimised, increasing the demand for affordable high quality resources in a hub like Beirut,” says Rahal. “Digital marketing initiatives are effectively trackable, allowing budgets to be spent on content that performs best, contributing to higher levels of content and technology being produced out of Beirut.”

“For me, the outlook is positive,” adds Abou Samra. “We’re in a virtuous cycle as our ecosystem grows with more and more hubs opening, adding talent and expertise in our market. This in itself will warrant further developments in our infrastructure and regulatory environment, which will attract even more companies. Sophistication is growing as talent comes on stream and demand builds up.”

.jpg)