News - Digital/Tech

The State of Digital Investments in MENA (2013-2018)

July 30, 2019

.jpg) Advertisement

AdvertisementThe State of Investors

When it comes to the investors’ distribution across the MENA region, countries like the UAE, Lebanon, and Egypt dominate in the GCC, the Levant, and North Africa respectively. Between 2012 and 2018, the compound growth rate of the number of tech investors in the MENA is 25%.

The distribution of investors by ticket size across markets mirrors the maturity level of the investor community per country. With the exception of Kuwait, early stage funds are the most prevalent across countries, representing around half of the investor community. On the other hand, growth capital witnessed a respective drop of 30% and 12.5% over the past six years, creating a possible market opportunity.

Over the past three years, the ecosystem has witnessed a proliferation of accelerators, with initiatives led by the World Bank, and the American seed accelerator Techstars. Increased corporate appetite and interest are also evident with the rise of corporate investors that are working on advancing their digitization process by supporting tech-focused solutions.

The State of Investments

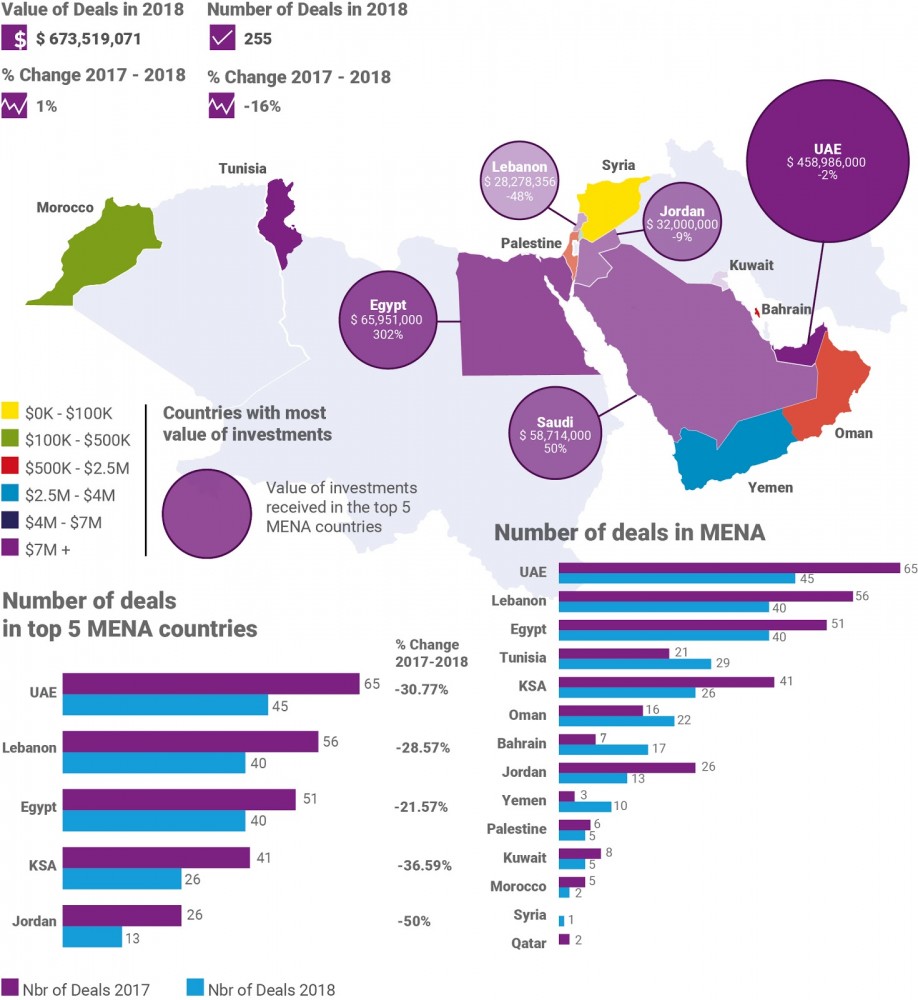

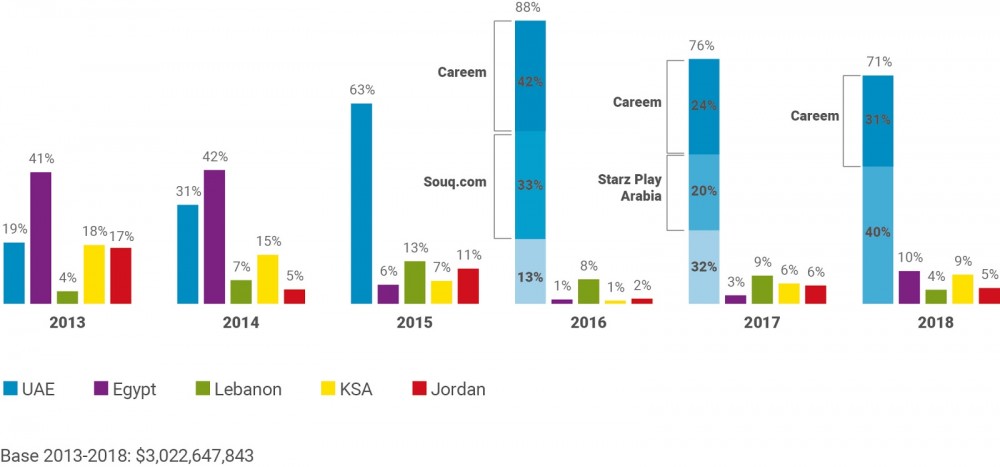

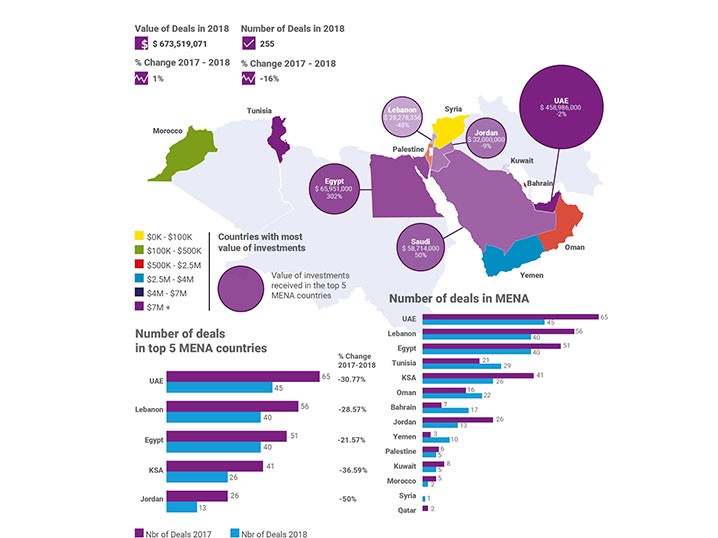

In 2018, 255 deals took place valued at $670 million. While the report examines investments by number, ticket size, and year in 15 countries, it takes a closer look at the top 5 countries: UAE, Egypt, Lebanon, Saudi Arabia, and Jordan.

The UAE has consistently secured the highest proportion of deals (45) among the top five countries in 2018, with Lebanon and Egypt closing in on the gap with 40 deals each. In terms of value of investments in the top five countries, the majority of the region’s investment money is concentrated in the UAE.

While lebanon ranks second in number of deals in 2017 and 2018, its ranking dropped from second to fifth place in 2018 in terms of value of deals, three spots from its previous ranking at number 2 in 2017.

This pattern of contrast in ranking when comparing numbers and values of deals is very apparent in countries like Kuwait, Jordan, and Oman.

Corporate Investors

In 2018, the total number of cumulative corporate investors reached 42, more than double the number of 2014. Corporate investments, mostly concentrated in the UAE and Saudi Arabia, contribute to 17% of all investors, and is on the rise. While the GCC captured 70% of all corporate investors, countries like Lebanon and Egypt have witnessed an increase in corporate investors throughout the years, reaching 12% and 7% respectively in 2018.

Gender Diversity

The report dedicates a section to examine the female participation in the ecosystem. According to the report, the proportion of female founders across the region remains at a low of 14% over the years despite the governments’ efforts for more female involvement in the labor force. The Levant, specifically Lebanon and Jordan, continue to exhibit the highest female participation at 20%, compared to North Africa, where countries like Tunisia and Morocco reveal the lowest percentage of female participation, with 9% and 10% respectively.

Despite that the number of deals for teams with at least one female founder has doubled in the past five years, all-male teams still captured the majority of deals, while teams with at least one female founder accounted for 11% of all dollars invested. The female contribution in the MENA region is a reflection of what female entrepreneurs are facing globally.

Gender diversity is gaining more interest in tech. In 2018, investments in team with at least one female founder makes up 25% of all deals. (The report suggests) Awareness campaigns and initiatives led by the private and the public sector could decrease the gap between male and female founders by tackling social and cultural factors affecting female representation in startups.

Valley of Death

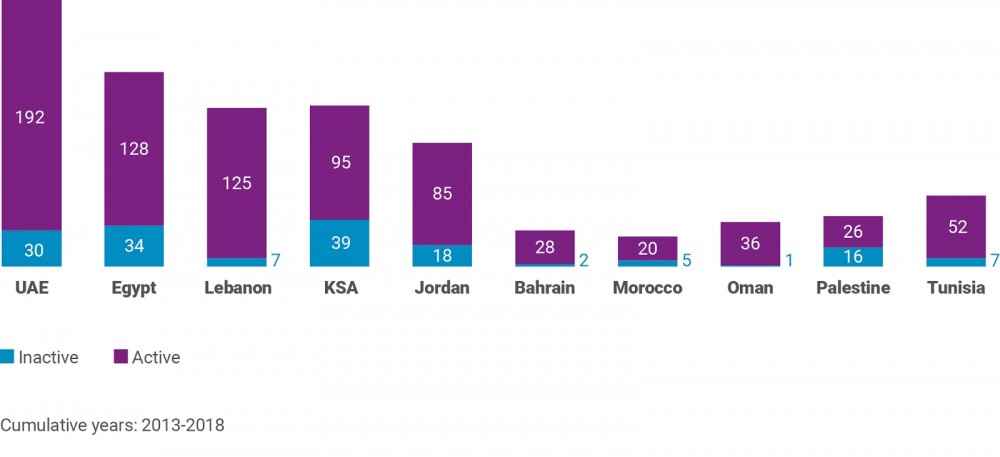

The report analyzes startups founded in the past five years and assesses their operational status. According to the report, only 14% of all startups in the MENA funded in the past six years have shuttered. This low failure rate is attributed to several factors, mainly the nascent nature of the ecosystem, where the volume of deals increasing from 2015 to 2017.

When examining operational startups by country, the UAE appears to have the largest number of operational startups with 192 operational startups, followed by Egypt (128). On the other hand, Lebanon presents the lowest proportion of closed startups (5.3%) compared to all other MENA countries.

Looking deeper into operational startups by year starting with 2013, several patterns could be drawn. Generally, closure rate after the first round of funding hover between 20% and 30%. Furthermore, in 2015, startups were able to reach new growth levels achieving six rounds of funding, indicating a maturing ecosystem. 2015 and 2016 stand out it terms of number of startups in the first round, with 152 and 169 startups respectively.

Click here to download report.

Click here to watch the report presentation and launch at ABX.

.jpg)