Industry Talk

Data transparency reignites Gen Z advertisers

by Edward Siavo

March 5, 2024

.jpg) Advertisement

AdvertisementTwo years ago, reporters exposed surrogate advertising by betting websites during PSL's 7th and 8th seasons. Subsequent to a Ministry of Information and Broadcasting inquiry confirming these claims, a letter was dispatched to key authorities urging a cessation of dealings with betting companies. This directive aimed to address challenges advertisers faced in justifying PSL investments, emphasizing deficiencies in AdEx transparency.

The media landscape signaled a shift, prompting even traditional advertisers to turn to PSL streaming. The industry's response underscores the need for increased transparency, revolutionizing how advertisers engage with the PSL on both linear and streaming platforms.

“The reality is that the companies that won the linear and streaming rights both failed to transparently provide advertisers with the data that would justify allocation of AdEx,” said Muhammad Ali Rehman, a real estate investor. “The exact opposite is happening this year, which is why even conventional advertisers are flocking to PSL streaming for reach.”

The ROI of data hoarding

During its bid for the 2024-2025 streaming rights, Daraz shared an impressive 368 million views for PSL streaming in 2022. Notably, the average viewing time slightly exceeded a minute. Despite this brevity, the figure points to a substantial audience turnout, signaling significant interest in watching the matches.

“It has been over a year and we have not received a report from Daraz on the effectiveness of our clients’ digital AdEx on their streaming service,” said Mikail Alvi, chief media officer of Team Reactivation. “Clients that allocate AdEx to digital expect data and this behavior is discouraging.”

Advertisers can access TV reach and ratings data through MediaLogic. However, for streaming services, there's a lack of third-party infrastructure for MRV. This compels streaming platforms aiming to attract advertisers to independently provide real-time data, often through a transparent dashboard.

“Unilever created SuperSauda in 2020 because Daraz refused to share data and insights on CPG shoppers,” said Rehman. “Daraz applied the same SOP when selling digital ad space for PSL streaming on its app. Unsurprisingly, advertisers that need data to determine such investments, did not go for their pitch.”

The transparency of 2024

After securing PSL streaming rights for seasons 9 and 10, Walee Technologies swiftly inked distribution deals with ad-supported platforms committed to transparent viewership data. While Tapmad and MHL's Begin depend on subscribers for PSL streaming, SnackVideo, Jazz Tamasha, and MyCo welcome advertiser engagement.

Walee introduced a vetted data dashboard at the start of PSL season 9 in mid-February, accessible to the public, enhancing transparency in streaming statistics.

“Unsurprisingly, this transparency - which is an SOP of companies such as Google and Meta - has flocked advertisers across the spectrum to Walee,” said Alvi. “As the streaming rights winner and the most trusted source of streaming data, Walee has become the principal focus for data-driven advertisers seeking AdEx placement deals across streaming platforms.”

Platforms like SnackVideo, Jazz Tamasha, and MyCo feature streaming advertisers, including Spotify, Jazz, Zong, Telenor Pakistan, Coca-Cola, PepsiCo, National Foods, Philip Morris, and more. These brands strategically align with the digital native psychographic, catering to the Generation Z demographic.

Interestingly, advertisers focusing on Gen Z and emerging youth opt for traditional linear and conventional media. This group includes renowned names such as Unilever, Tapal, Foodpanda, Nestle, Samsung, and Colgate Palmolive.

“Most of these advertisers are clients of the affiliated agencies with dinosaurs making decisions based on TV channel kickbacks,” said Alvi. “Instead of directing clients to streaming to better reach their actual target audience, media buyers directed them to linear TV where the youth penetration is at an all time low. Coupling this with the opaque pricing of linear TV helps line the pockets of buyers, whereas digital is inherently transparent.”

Not their first (data) rodeo

Since 2019, Walee, a key intermediary for content creators and advertisers, manages digital reach metrics, measurement, reporting, and verification. Despite uncertainties in emulating MediaLogic's streaming role, Walee, among well-funded startups, navigated the fundraising crunch, expanding operations.

Walee's public streaming dashboard release supports industry data transparency. Positive strides may lead PCB to raise PSL streaming rights prices in future bids. The bid surged 175% in 2021 and an additional 113% the next year. Walee secured rights with a substantial $7 million bid, a notable increase from the $2.7 million raised three years prior.

“Walee’s overwhelming financial muscle comes from customer success teams across the MENAPT region, including partnerships with agencies such as Havas Red, including closing powerhouse GCC advertisers such as Aston Martin, MBC Group and STC,” said Alvi. “This is thanks in part to having six ISO certifications, opening doors to a multitude of regional partners and clients.”

PCB's readiness signals an intention to elevate PSL's streaming rights valuation globally. Despite being a national pride, primarily backed by HBL, PSL, a significant asset for Pakistan, faces a substantial journey to rival the IPL. In the recent bidding cycle, IPL's media rights reached $6 billion, with a significant part allocated to streaming.

Advertisers predict streaming will outperform linear platforms due to evolving user behavior and a better advertiser experience, driven by the imperative of data transparency.

“We’re putting all our AdEx eggs in the streaming offering because we want to be where the hockey puck will be,” said Rubab Rizvi, chief data scientist at Brainchild. “In the last five years, data consumption has increased five times while broadband subscribers have doubled in the same period, indicating higher accessibility to digital streaming platforms.”

The big change in 2024

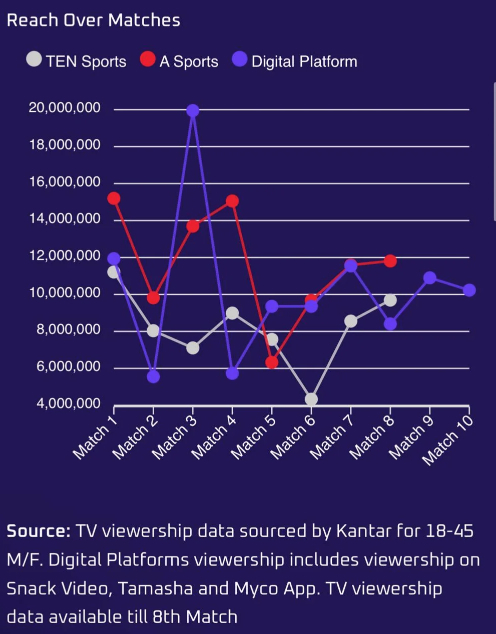

In 2024, PSL introduces its ad-free era via Tapmad and Begin.Watch, marking the onset of data transparency. Walee's streaming dashboard reveals:

• Avg. engagement: 100,000+ views/match

• Avg. viewing duration: 19+ minutes

• Initial ten matches: 140+ million views

This indicates a shift in viewer behavior, enhancing streaming accessibility. Positive sentiments in AdEx-supported platform comments showcase an interactive experience, creating new opportunities for fan engagement and signaling a significant change in user and advertiser experiences.

.jpg)