News - News In Brief

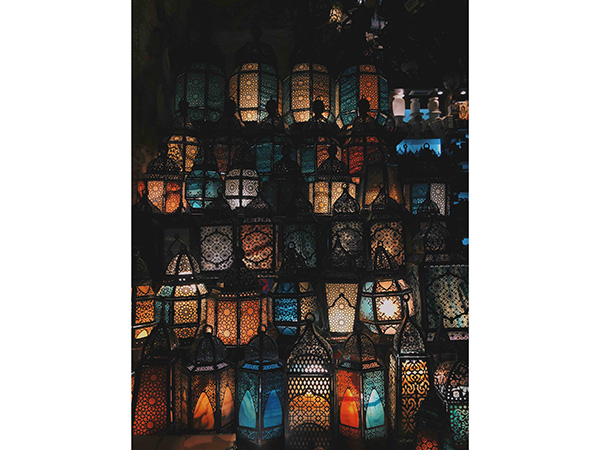

Toluna and MatrixLab survey highlights Saudi consumer trends shaping Ramadan and Eid 2025

by ArabAd's staff

February 18, 2025

.jpg) Advertisement

AdvertisementAs Ramadan 2025 approaches, residents of Saudi Arabia are preparing for a season of heightened spending, with 47% planning to increase their budgets for shopping (56%), socializing (43%) and entertainment (41%) compared to 2024.

The Toluna MatrixLab survey reveals significant spending growth across key categories, including gifts, dining, and cultural activities. Residents are delaying major purchases to benefit from Ramadan-specific promotions, while the winter setting encourages a mix of traditional gatherings and outdoor leisure, creating a dynamic and meaningful festive season.

A Winter Ramadan Brings Outdoor Excitement and Home Comfort

With winter weather enhancing the Ramadan experience, 56% of KSA residents expressed increases excitement about outdoor activities compared to 2024 including family-friendly dining (+15%), barbecue spots (+11%) and outdoor food markets (+11%).

Balancing this enthusiasm for outdoor leisure, 83% of residents plan to spend more time at home, prioritizing family bonding through home-cooked meals, with 83% favoring them over fast food.

Healthier lifestyles are also gaining traction, with 19% planning to eat healthier meals. Additionally 20% are preparing to host more Iftar gatherings at home.

Traditional Foods & Beverage See Increased Demand

Winter Ramadan will bring increased demand for traditional staples, with 45% of consumers planning to purchase more dates than 2024. Additionally, 39% plan to increase their spending on traditional sweets and beverages. Consumers also expect to spend more on special Ramadan beverages 36% and dairy products are also to witness an increased consumption (39%).

Significant Spending Expected Across Key Categories

Ramadan continues to drive consumer spending, with nearly 76% of KSA residents delaying some of their purchases to take advantage of Ramadan-specific promotions. For instance, consumers are planning to spend significantly more than 2024 across core categories, including groceries (59%), chocolate, dates, and sweets (50%), fashion clothing (49%), and fragrances (47%), skincare products & home goods & furniture (41%).

Strategic Bulk-Buying

A significant 43% of consumers plan to bulk groceries one week before Ramadan an 36% to buy household cleaning items one week before Ramadan.

This highlights a strategic approach where groceries and households prioritize stocking up on cleaning supplies well in advance, ensuring their homes are prepared before Ramadan begins.

Major purchases like cars (17%) and shopping for new outfits for Iftar/ suhur are expected to be finalized 2-3 weeks before the start of Ramadan while staycations (18%) and start buying Eid Gifts (32%) will take place throughout the month.

Moreover, when it comes to Saudi-made products, food & beverages and fashion & lifestyle emerged as the top 2 categories that KSA residents would ‘buy more in Ramadan than rest of the year. F

or instance, 43% prefer to buy during Ramadan Saudi made food and beverage products and 38% to buy local made fashion.

A New Car

Automotive spending is set to remain significant during Ramadan, though interest has slightly declined compared to 2024. In 2025, 36% of KSA residents consider to purchase a new car down from 43% in 2024 while 20% will buy a new car, a drop from 22% the previous year.

Consumers remain interested in Ramadan Car promotions with key incentives including price discount (27%), 0% finance charges on car loans (19%) and low interest rates on car loans (14%)

Dining Patterns: Blending Traditional and Modern Experiences

Dining will be a mix of traditional and contemporary experiences, with 83% preferring home-cooked meals rather than fast food during Ramadan.

However, dining out remains an essential part of the season, with residents favoring family-friendly restaurants (25%), Iftar -only restaurants (17%), caffe and coffeeshops in addition to food markets (19%). During Eid, 73% of residents plan to dine out at restaurants.

Eid Gifting: Personalized Choices with Growing Budgets

Eid will be defined by generosity, with 89% of residents planning to buy gifts for family members, primarily children (74%), spouses (63%), and parents (48%).

Popular gift categories include fragrances (50%), chocolate, dates, and sweets (45%), money (42%), and toys (36%) with (44%).

Self-gifting is expected to grow as 51% of residents plan to spend more during Eid, driven by a desire to create lasting memories & prices are higher than last year (38%). improved personal finances (36%)

Eid 2025: Stronger Focus on Family, Entertainment and Cultural Experiences

As KSA residents prepare for Eid 2025, social gatherings will take center stage. Visiting relatives and friends remains the top priority with 84% planning to do so. Shopping malls continue to be a major attraction with 79% planning to for the purpose of shopping and 72% for entertainment and 67% to visit theme parks.

Interest in cultural activities has also risen to 57% signaling a stronger engagement with traditional and community-driven celebrations. Meanwhile, travel remains as integral part of the holiday, as 49% planning international trips and 66% considering staycations.

Digital Media and Influencer Engagement Play Key Roles

Digital media will be integral to Ramadan 2025 campaigns, whereas KSA residents to turn more this year to platforms versus 2024, such as TikTok and Snapchat (24% vs 20%), with YouTube experiencing a significant spike at 31% in comparison to 25% in 2024, and Facebook (19% vs 16%), primarily to discover cultural & traditional content (37%), family values (36%), entertainment (35%) charity (32%), beauty & personal care (31%) and Ramadan fashion trends (32%).

Influencers and digital campaigns will play a critical role in shaping consumer choices, particularly for limited-edition collections and festive promotions.

Online Shopping Growth Accelerates Ahead of Ramadan 2025

Online shopping in the UAE continues to gain momentum, with heavy online spenders increasing to 31 % in 2025, up from 28% in 2024. This indicates a growing segment of consumers who shop multiple times a week or daily. Medium online spending remains dropped from 42% to 40% while light online shopping has declined to 29%, suggesting a shift toward more frequent e-commerce purchases.

During Ramadan 2025, online shopping will be particularly strong for fashion-cloths (35%) and skincare products (34%) reflecting a preference for convenience and efficiency.

Sustainability and Charitable Initiatives Drive Consumer Preferences

Sustainability and charitable giving continue to influence spending habits, with 76% of residents favoring brands that contribute to charitable causes. In addition, 17% would be motivated by brands offering charitable contributions based on their purchases.

Residents’ Expectations from Banks and Preferred Offers

Banks will play a vital role during Ramadan by offering financial flexibility and rewards tailored to consumer needs. Key expectations include cashback offers (44%), promotions on online shopping (44%) and in-store purchases (39%), dining (33%) credit card sign-up benefits (28%), and deals on flights (28%). These offerings reflect consumers’ desire for financial incentives that align with their increased spending on food, travel, and major purchases.

A Strategic Opportunity for Brands

Ramadan 2025 presents a crucial opportunity for brands to connect with KSA consumers through personalized promotions, digital engagement, and meaningful community involvement.

Georges Akkaoui, Enterprise Account Director at Toluna MEAT, remarked: “Ramadan 2025 in the KSA presents brands with a rare opportunity to blend tradition with innovation. By understanding the importance of digital engagement, personalized experiences, and community-centered initiatives, brands can foster genuine connections with consumers. As shopping, dining, and social interactions continue to evolve, those who align their strategies with the values of Ramadan—generosity, sustainability, and cultural authenticity—will not only thrive during the season but build lasting brand loyalty well beyond it.”

.jpg)