News - News In Brief

Middle East consumers prioritise sustainability while shopping, new PwC report finds

March 22, 2022

.jpg) Advertisement

AdvertisementThe latest edition of PwC’s Global Consumer Insights Pulse Survey showed that Middle East shoppers are increasingly influenced by sustainability issues and prioritising health and wellbeing.

The survey highlights a general shift in consumer behaviour as a result of the pandemic and the staying power of those changes. For example, Middle East shoppers believe they are now healthier (67% vs. 51% globally), more digital (65% vs. 53% globally) and have better work-life balance (66% vs. 60% globally).

They are also more likely than ever to take into account sustainability considerations when making a purchase. In fact, 60% of regional respondents believe they are more eco-friendly than six months ago and 53% are always or frequently buying eco-friendly products (vs. 42% globally).

Norma Taki, PwC Middle East’s Consumer Markets Leader, said: “A range of factors, from mass remote working to tech-driven regional transformation, have changed and continue to change consumer shopping habits and attitudes, and it is clear now that those changes are here to stay.”

“As consumer optimism continues to grow in the region, it is essential that retailers and consumer companies take note of these shifting trends and adapt their priorities and strategies accordingly,” Taki added.

Multi-channel consumer society

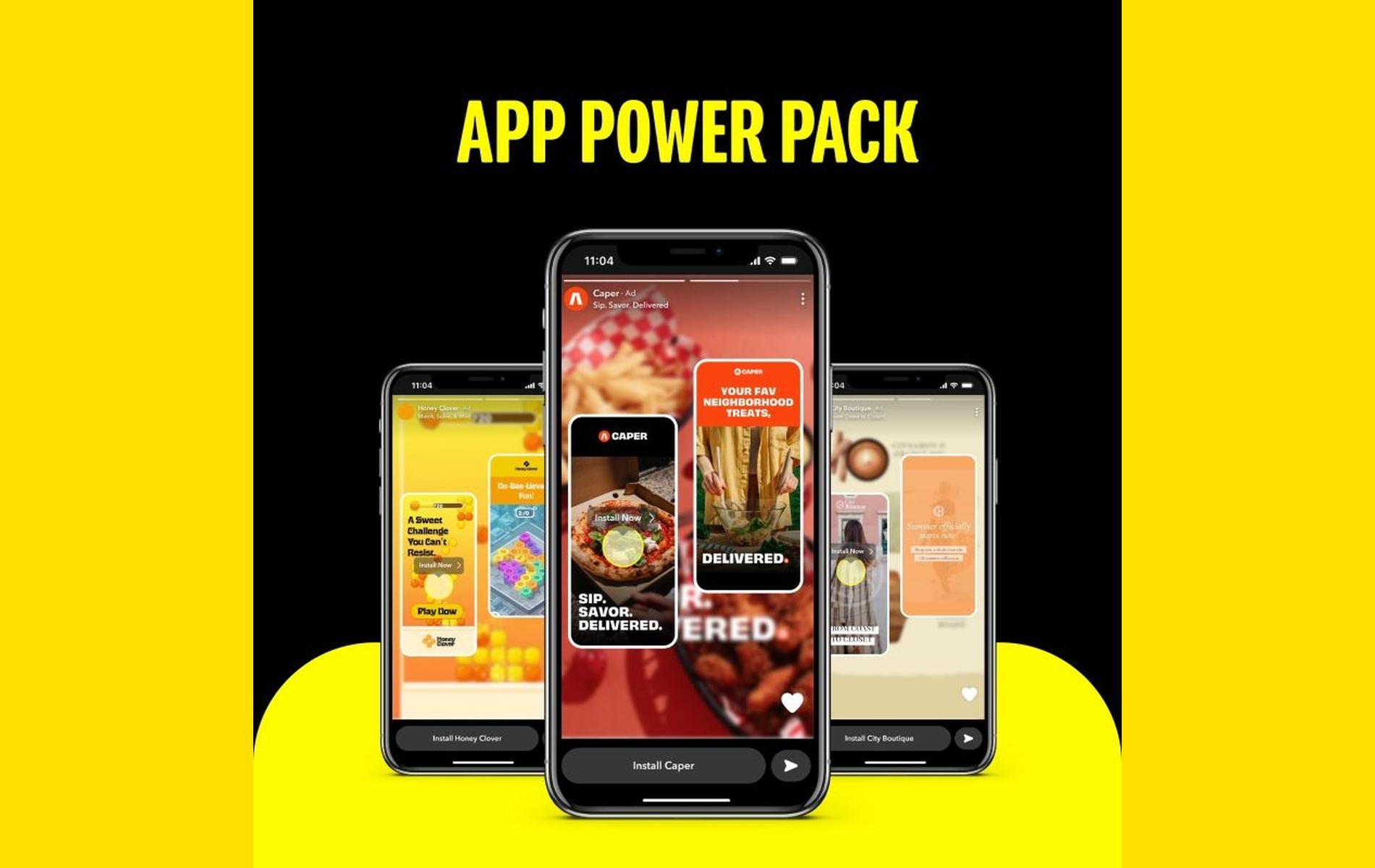

According to the survey, the pandemic has also paved the way for a more multi-channel consumer experience, with 45% of regional shoppers reporting that they shop through their smartphone regularly, reflecting a global trend.

That said, in-store shopping remains the most popular channel for frequent purchases in the region, with 50% of consumers choosing to visit physical stores on a daily or weekly basis.

Premium on price and convenience

The results also highlight that Middle East consumers are not immune to the threat of rising inflation. Shoppers are now more price-conscious and on the hunt for deals and bargains. Overall, 60% of Middle East consumers say they have become more focused on saving in the past six months, while 52% are now more price oriented.

Growing consciousness around data privacy

Amid rising worries about exposure to online threats and scams, regional consumers have become more protective of their personal data in recent months. 68% said they are guarding their data more strictly than before, compared to 59% globally.

Furthermore, 55% of the regional respondents, versus 47% globally, say a brand’s ability to protect their personal data affects how much they trust it. This increased focus on data privacy is here to stay, particularly as retailers continue to embrace digital platforms.

Roy Hintze, Partner, Consumer Markets at PwC Middle East, ended: “Moving forward, it is essential that consumer companies adapt and respond to shifts in consumer behaviour by developing a true omni-channel customer experience, embedding ESG in their supply chains, building sustainable product portfolios and prioritising data privacy.”

.jpg)