Listen to the article

Marketing in a cost of living crisis, a shift in Big Tech strategies, and audience fragmentation are some of the big challenges for brands in 2023, as revealed by WARC’s Marketer’s Toolkit 2023: Global Trends Report, released today.

Providing marketers with a set of planning and decision-making tools, the Marketer’s Toolkit 2023 report is built around six key drivers of change - society, technology, economy, policy, industry and creativity.

Aditya Kishore, Insight Director, WARC, says: “We began the year hoping to put the economic havoc of the pandemic behind us. Instead, within weeks the war in Ukraine has had a transformative impact on energy prices, inflation and the cost of living around the world.

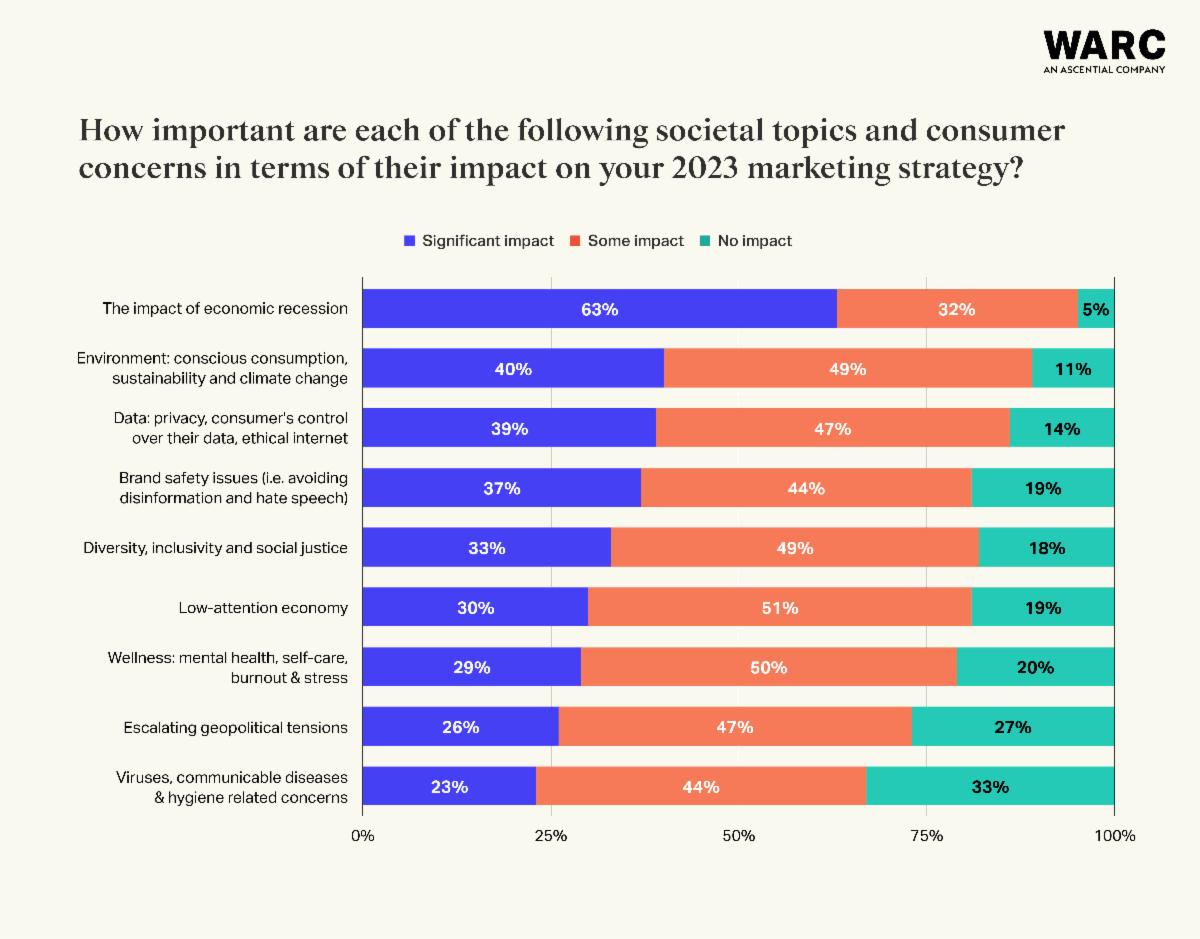

“Our Marketer’s Toolkit survey of 1,700 marketers worldwide found that 95% expect to be impacted by economic recession. While it will undoubtedly be the single greatest global concern, there are other issues marketers will need to contend with, such as climate change, supply chains, media fragmentation and cultural divides. The coming together of all these factors is creating one of the most challenging marketing environments in recent history.

“Uncertainty will rule in 2023, but marketers who are able to drive transformative change in consequential areas can benefit from emerging opportunities. The 2023 Marketer’s Toolkit is designed to help companies find and focus on these opportunities, and make the most of the coming year.”

The top five key findings and most important areas of change that are addressed in WARC’s Marketer’s Toolkit 2023 are:

- 95% of marketers expect to be impacted by the economic recession

The combination of inflation and a probable recession makes this an atypical downturn. 95% of survey respondents say the impact of recession is affecting their planning.

The long-standing advice to marketers to maintain ad spend and build share of voice is even more important as consumers are more likely to seek out less expensive brands. While 36% of Toolkit respondents say they plan on reducing marketing spend, importantly and up from 23% last year, 31% now say they are increasing spend.

Linda Lee, CMO, Campbell Soup/Meats and Beverages, says: “The recession is real. That's something that's led to a new effort on our end around value, marketing and messaging. At a time like this, it's important to not cut back on our marketing. [It's a time to]... lean in. But not just to market, it’s to lean into how we can help our consumers.”

With price increases being a major concern for consumers, marketers should assess individual brand price elasticity. Strong brands, which focus more on brand advertising than price promotions, can weather price increases better.

The tone of messaging is also important in building connections with customers. Humour, an underutilised technique, if used well, can be a competitive advantage, even during tumultuous times.

- 62% of marketers agree that the Big Tech companies are being forced to shift strategies in the face of a range of changing market factors

Growth is slowing in Big Tech’s core sectors, including digital advertising and e-commerce, and Alphabet and Meta’s ‘duopoly’ is being challenged. For the first time in six years there is a negative investment sentiment towards Facebook, with 30% of survey respondents planning on decreasing their investment versus 23% who are planning to increase.

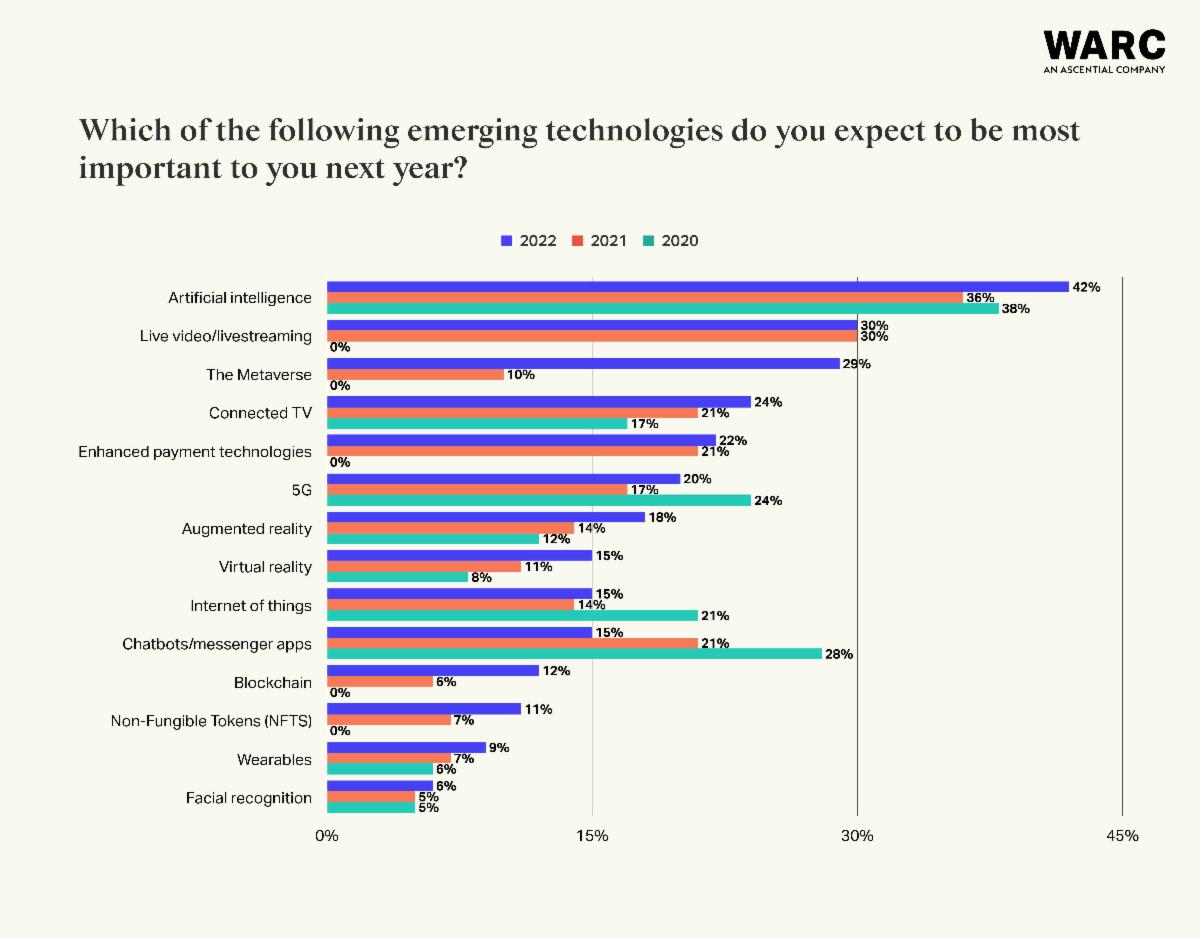

As Big Tech companies seek new sources of revenue, from digital healthcare to the metaverse, they could do well to prioritise artificial intelligence (AI) capabilities. For a third consecutive year, survey respondents have named AI as the most important emerging technology for their brands.

The rise of TikTok and Amazon as media owners, and newcomers like Netflix joining the advertising space, may enable marketers to reevaluate and recalibrate media plans to better suit their brands’ needs.

Conny Braams, Chief Digital and Commercial Officer, Unilever, says: “Behind the scenes, we’re working to ensure we play a part in making this evolving arena representative, inclusive and safe for everyone who uses it. Robust governance around issues such as data privacy, safety, equity, diversity and inclusion, sustainability and ethics needs to be established, and we’re using our scale and global profile to help set future-fit foundations for our business and beyond.”

- 34% of marketers are concerned about media and audience fragmentation, which is now influencing budgets

Culture formation is increasingly a “bubble up” phenomenon that is shaped by communities, “tribes” and fandoms across a decentralised media ecosystem.

For marketers, this means a rethink of the traditional notions of “mainstream”. Taking part in the “bubble up” culture will require brands to find authentic ways of engaging with numerous different communities while remaining true to a clear, overarching brand proposition.

Creators are especially popular with Gen Z. For marketers and media owners, these influencers are a route to cultural relevance and authentic partnerships can yield significant benefits for all parties.

Two-thirds (66%) of respondents expect a rise of investment in targeting interest-based communities. 63% said the same for gaming – a space where community is deeply embedded – and 52% plan to increase their budgets with influencers and other social media content.

Anubha Sahasrabuddhe, CMO, Lion Breweries, commented: “Now, we are able to aggregate or cluster through profiling around values or passion points. But whether you can identify three or 30 relevant tribes, what has to be unchanging is your brand’s core values.”

- 26% of marketers expect significant or severe supply chain issues

Political, economic and environmental drivers are affecting brands’ access to a range of raw materials, foodstuffs, gas and oil, amongst other critical items. Managing customer expectations while minimising supply disruptions will be crucial for marketing success in the coming year.

Supply chain challenges will vary by region and sector. The brands able to maintain consistent availability and regular delivery will have an advantage. Smaller brands with fewer resources could lose out as a result: 28% of survey respondents thought that small and medium businesses would be worst affected while 52% felt challenger brands in particular, would be the hardest hit.

Marketers can help manage the impact by proactively addressing the challenges and driving effective customer communications. Deeper data analysis and scenario planning can help brands improve marketing and supply.

Antonia Wade, Global CMO, PwC, said: “The war in Ukraine, the continuing COVID-19 pandemic, rising inflation, an energy crisis, supply chain disruption and the pressing needs to address climate change combine to produce some of the most difficult sets of global circumstances that business leaders have seen in their careers.”

- 72% of marketers anticipate their environmental plans will remain unchanged but for 28% the outlook is less optimistic

The threat of climate change is frequently placed in opposition to the short-term urgency of driving sales in a financial crisis. The current moment of economic stress, however, is an opportunity to bring affordable, eco-friendly products into the mainstream and secure future mass market demand.

With household budgets under pressure, brands should find the sweet spot across value, convenience and sustainability; make it easy by treating green credentials as a “gift” instead of requiring behaviour change; embrace “eco-accidentalism” so this choice is the default; and make consumers feel good about these purchases.

Brands should look to more experienced markets for guidance and inspiration to kickstart new modes of strategic thinking for positioning sustainable goods.

Ye Danpeng, CMO, Robam, said: “Short-term fluctuations only cause short-term uncertainties, and there can be some tactical adjustments, but strategic determination cannot be shaken.”

The 12th edition of The Marketer’s Toolkit brings together insights from a survey of 1,700+ marketing executives from around the world, one-to-one interviews with 13 marketing leaders, and in-depth reviews of WARC’s latest proprietary research, forecast data, case studies and industry information conducted by WARC’s global team of experts.

-Final-EN.jpg)