News - News In Brief

UAE shoppers are the most mobile centric, omnichannel consumers in the world, finds PYMNTS-Visa CyberSource Survey

November 7, 2022

.jpg) Advertisement

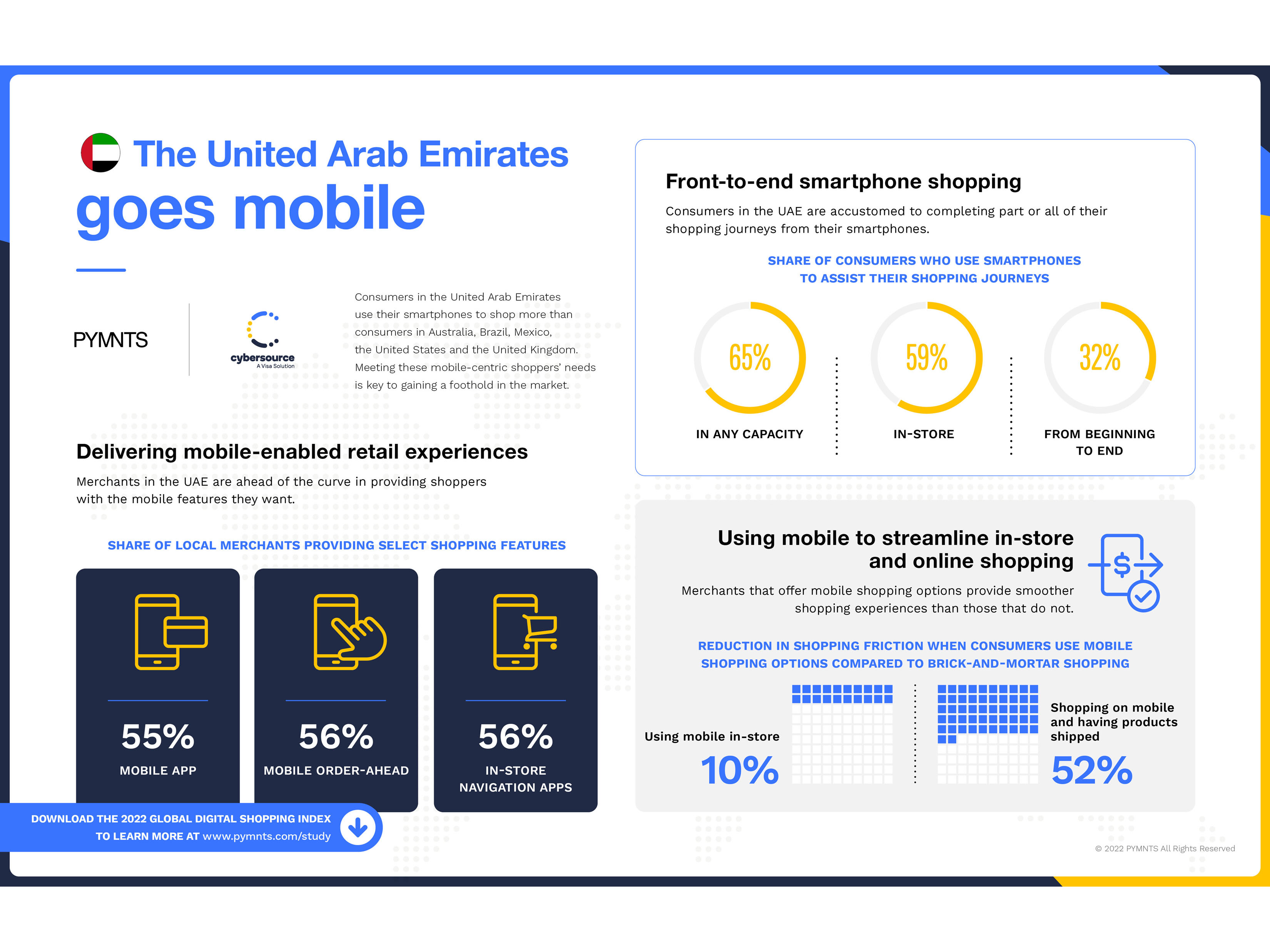

Advertisement72 percent of in-store shoppers in the UAE said they are more likely than others to use their smartphones to enhance their shopping experience, especially to look up product information and compare prices at other merchants using their devices, according to “The 2022 Global Shopping Index: UAE Edition,” a PYMNTS and Visa Cybersource survey, Visa’s payment gateway and risk platform.

UAE consumers’ strong penchant for mobile-enabled shopping experiences is just one of many traits that make the country’s eCommerce market unique on the world stage.

Conducted across Australia, Brazil, Mexico, UAE, the United Kingdom and the United States, the survey delves into the details of what separates the UAE eCommerce market from other major world economies — and what those differences mean for the businesses looking to make their mark.

The survey polled 13,114 consumers and 3,100 merchants in six countries to find out how shopping preferences in the UAE differ from those in other countries, which shopping and payment features local shoppers want most, and how well local merchants are meeting their customers’ demands.

“UAE shoppers’ strong preference for mobile commerce touches every aspect of their shopping journeys, including their in-store shopping experiences. Meeting these mobile-centric shoppers’ needs is crucial to the success and growth of businesses in a market that is steadily progressing in its cashless journey,” said Dr. Saeeda Jaffar, Visa’s SVP and Group Country Manager for GCC region. “With the growing interest in online and mobile shopping in the country, responsible digital retailers are looking to improve their systems to provide their customers with a seamless and secure shopping experience online and in-store shopping experiences for customers. These statistics allow retailers to identify challenges and adapt to consumers' mobile preferences to make their retail journey safe and frictionless."

Key findings from the survey include:

- Smartphones are integral to both the in-store and remote shopping experience in the UAE. Sixty-five percent of UAE consumers used smartphones at some point throughout their most recent retail journeys, regardless of whether they were shopping in-store or remotely online. This makes them 52% more likely to use their smartphone at any time for any reason than the average consumer in all six countries studied in the report. About 60% consumers have used their smartphones for in-store shopping while over one-third (32%) completed their last purchase entirely via a smartphone.

- UAE shoppers use in-store and curbside pickup options more frequently than those in other countries. Nearly one-third of all local eCommerce shoppers picked up their most recent purchases in-store or via curbside pickup, which is more frequent than shoppers in other countries.

- UAE merchants are striving to deliver mobile-enabled retail experience. UAE merchants are far more likely than their counterparts in other countries to provide mobile-based features for their brick-and-mortar shoppers. Seventy percent of merchants offer cross-channel digital profiles, allowing consumers to access their identification and payment information both in-store and online. In other words, UAE merchants are 10% more likely than the average merchant across all six countries to provide digital profiles that their shoppers can access both in-store and online.

- UAE merchants provide the cross-channel shopping features consumers want but not of the quality they demand, exacerbating shopping frictions. UAE consumers who order items on their smartphones and pick them up in-store encounter 35% more shopping friction than the average across all six countries, indicating that the quality of the mobile features they are using may not be on par with those seen elsewhere. Nevertheless, the shoppers who use these features while shopping in-store encounter 10% less shopping friction than those that do not use the features in-store.

.jpg)